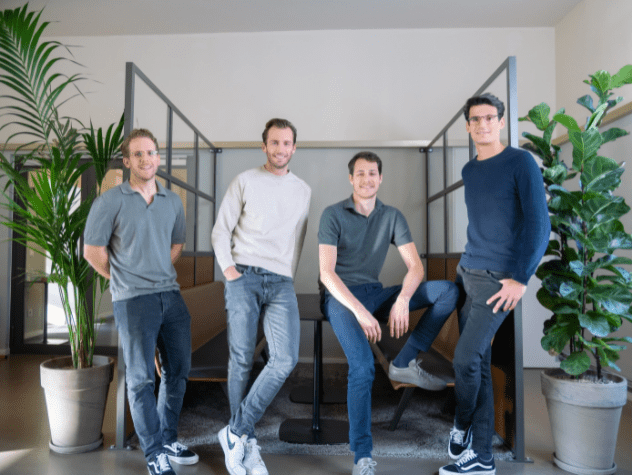

Moss, a startup based in Berlin, announced early last week that it closed a new $86 million funding round (Series B). The company operates a corporate credit card service for small and medium companies to track and monitor their spending.

After the Series B funding round, the startup now has a valuation of $537 million. The funding round was led by Tiger Global Management, with A-Star participating.

The company has raised close to $150 million in total. In a nutshell, Moss is a spend management service. That competes with other players in the European Union, including Pleo, Spendesk, and Soldo.

What makes Moss special

Even with competitors, Moss has an edge because it offers credit cards and not debit cards. However, the transactions still appear in the users’ moss dashboards just seconds after authorizing payment.

It’s not just physical cards; Moss allows users to use virtual cards for online payments. Whenever they make a purchase, the company gives them 0.4% cashback on all expenses. Team leaders can set budgets for every employee and easily track the expenses.

Corporate cards are not a common thing in the bloc, which is why when employees switch to Moss, employers don’t have to pay out of pocket for employee expenses, using a Moss card instead and attaching the receipt to that transaction.

Centralizing payments

Furthermore, if an establishment does not accept card payments, Moss takes care of the cash expenses and reimbursements.

In addition to payments requiring cards, Moss also offers to cover other payments by putting all your invoices in one account.

Moss users can set what rules should be followed to approve and export payment lists for business bank accounts. Integrating with Datev, a widespread accounting software in Germany, expedites accounting tasks. Moss has processed 250,000 transactions and issued 20,000 cards to date.