Vista Equity Partners is considering selling data management provider Tibco Software. CNBC reported that the deal could be worth $7.5 billion or more, attributing the information to multiple sources familiar with the matter.

The potential $7.5B price tag was mentioned by one of the sources, though another insider was quoted saying it was low.

It is unclear whether Vista will go through with the sale since the private equity firm has not begun negotiating with any potential buyers or hired investment banks to help with the transaction.

Maybe soon

Vista could be planning to hold discussions with several banks in the coming days. Tibco was launched more than two decades ago as a software provider to enable financial applications to share market data.

The company went public in 1999, two years after its founding, and managed to survive the dot-com bubble crash, establishing itself as one of the leading market players in the application integration market.

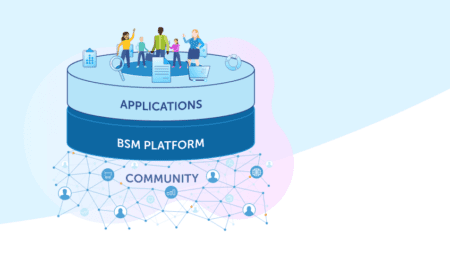

Enterprises integrate internal workloads, analysis tools, and databases with one another to power automatic data sharing. A company could, for instance, connect its units/subsidiaries’ analytics systems to a central data lake so analysis can take place in one location.

Tibco

Tibco sells software tools that companies leverage to enable faster integrations. The tools avail click-and-point controls to streamline the crucial parts of the integration devs process.

The company also sells software companies use to overcome common technical challenged involves in data sharing between applications. The challenges include things like the fact that records often have to be modified before migration between systems.

By the time Vista acquired Tibco in 2014, its revenue stood at a little over $1 billion. Vista spent more than $4.3 billion for the acquisition but since $7.5 billion is seemingly low, it indicates Tibco has experienced significant growth since 2014.