Yesterday Oracle announced the latest version of The Oracle Exadata Database Machine, better known as Exadata. The latest version goes by the name of X9M and is the successor to 2019’s X8M. The performance improvements are impressive, compared to its predecessor. This while the price has not changed. We spoke with Reinier van Grieken, EMEA VP Cloud Systems at Oracle, about this announcement.

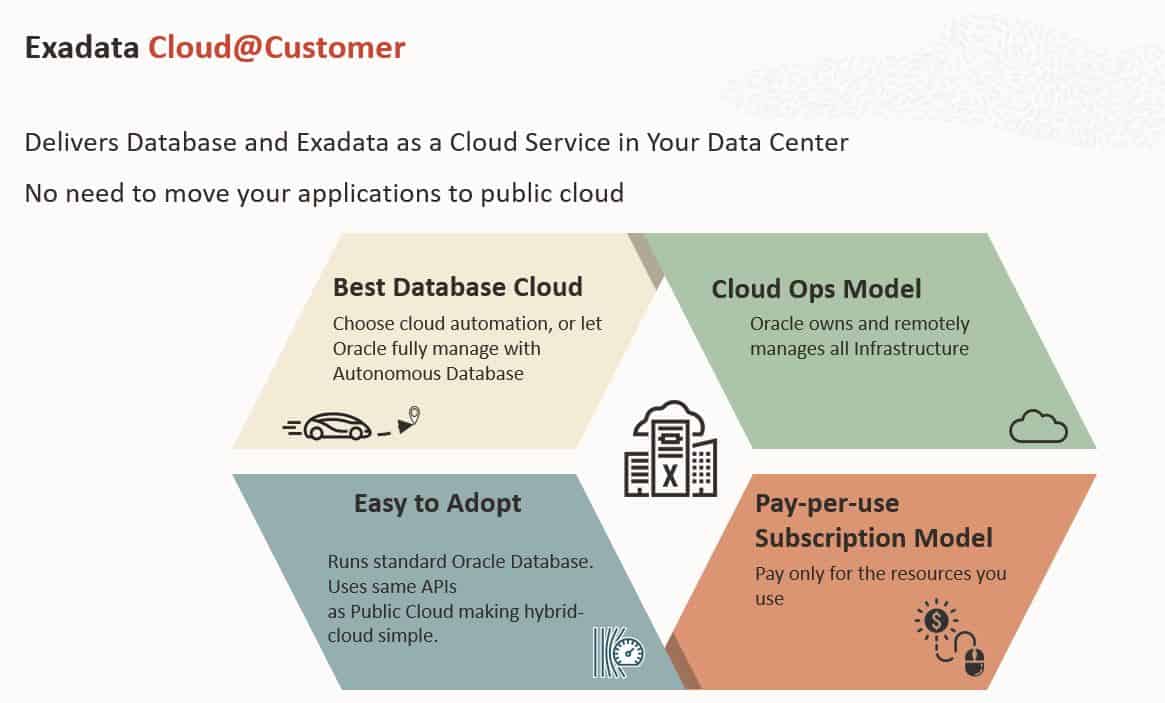

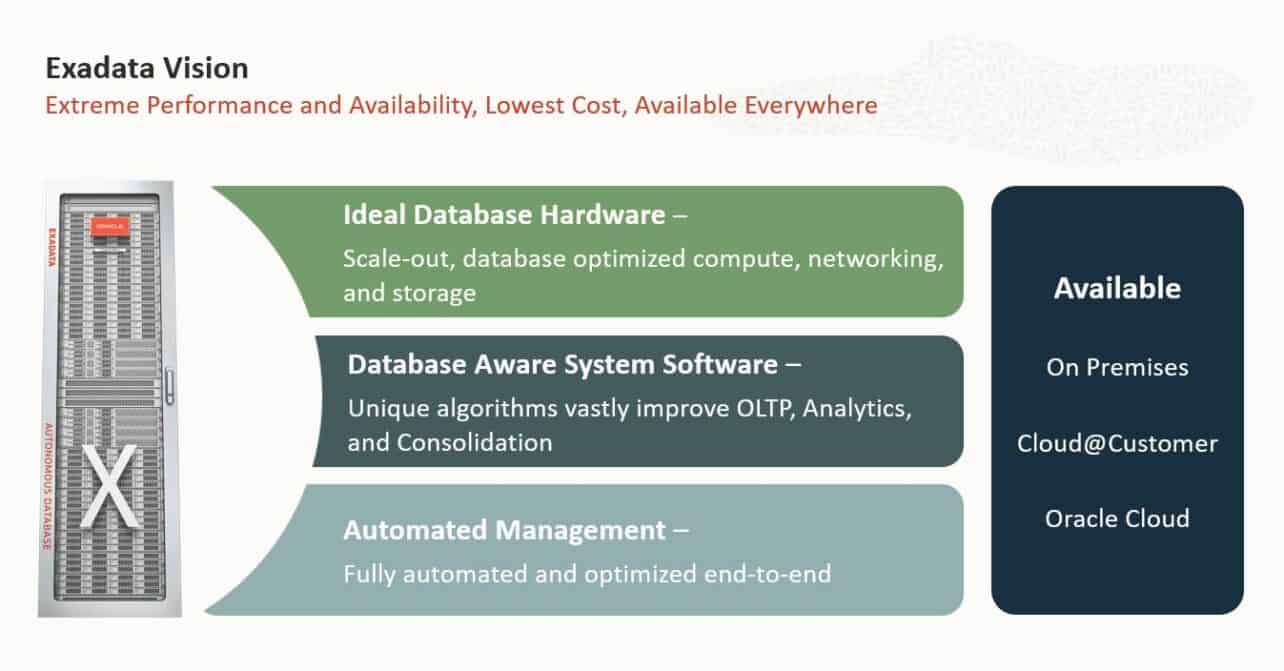

Exadata is unique in the market. This is because it is not only a software platform for running databases, but also a hardware platform. That is, Oracle builds both the hardware and the software. This ensures that the two components can be optimized to a high degree. This applies not to the only on-premises offering, but also the cloud offering, on Oracle Cloud Infrastructure (OCI). With Exadata Cloud@Customer, Oracle also has a third way to run Exadata. This last option is very popular in Europe, Van Grieken tells us. This is mainly due to the fact that within EMEA there are more than 120 countries, all with their own laws and regulations, and Oracle does not have a physical presence with a data center everywhere. In such a geographical area, Cloud@Customer is an interesting option if you need its performance for your workloads.

Much more powerful, for the same price

As already indicated in the introduction, Exadata X9M offers significantly better performance than its predecessor, X8M. The kind of high-performance databases that run on Exadata are mainly used for things like OLTP (for example, in banks) and for analytics. On the OLTP front, Oracle claims a 70 percent performance gain when it comes to OLTP IOs/s, coming from 33 percent more cores. The OLTP IO latency is below 19 microseconds. Oracle also claims performance gains in the area of analytics. The so-called Analytic Scan throughput has gone up by 87 percent and now has a bandwidth of 1 TB/s. Here, too, of course, 33 percent more cores are available for parallel data analysis and network throughput has been strongly increased, by 80 percent.

In part, this performance gain can be attributed to Intel’s newest generation of more powerful x86 processors. In that respect, Oracle is of course simply following that roadmap. But the choice of other hardware in the systems themselves also plays a role. Think of the choice of persistent memory (PMEM), which is about 10 times faster than flash, or the PCIe 4.0 RoCE network cards with a bandwidth of 100 Gbps. The systems also do not use standard I/O, but RDMA, to read the PMEM. The hottest data is in PMEM, the slightly less hot in flash and the cold on HDDs.

These improvements seem to be a natural progression of performance for Oracle. At least that’s how we interpret it, given the fact that Oracle Exadata X9M is no more expensive than its predecessor. Cheap in an absolute sense, of course, Exadata is not, but you can’t expect that from this kind of machine. However, by combining the much higher performance and the same price, the whole thing has become undeniably more affordable. You get 28 percent more storage, 33 percent more cores, a 33 percent higher memory capacity, at the same price as before. So organizations can now achieve the same with less investment, or more with the same investment.

Exadata continues to surge

The above figures are quite impressive in themselves. However, we are more interested in what all of it says about where Oracle wants to go with Exadata. And what this means for Oracle’s (potential) customers. We put these questions to Reinier van Grieken. Van Grieken has worked for Oracle for some 25 years and has actually been involved with Exadata since he joined the company. The first sale he made was before Oracle took over Sun Microsystems. So that was still a system without the Oracle logo.

Van Grieken is actually rather surprised that Exadata continues to grow rapidly. At the very beginning, the database platform was actually only interesting (and probably affordable) to, for instance, large banks, where a lot of data always went through the systems. At a certain point he expected that the growth would be over, especially with the rise of the cloud. But nothing turned out to be further from the truth. Exadata continued to grow very fast, he says. The explosion of data at more and more companies undoubtedly helped with this growth. There are simply many more workloads now that require of can benefit from the performance of the Exadata platform. Coupled with the platform becoming more accessible, and available as small as 1/8 rack, this means more customers.

Van Grieken also really sees an expansion of the target market for Exadata. That is, he sees more and more smaller customers joining. Often, customers are stepping in on a single workload for which they want to use Exadata. Since customer satisfaction with Exadata is generally very high, according to Van Grieken, customers expand it more or less automatically.

Cloud as the end goal

We recently wrote a comprehensive article about Oracle’s cloud journey. Exadata is also a major part of this journey, if we listen closely to Van Grieken. When he talks to customers or prospects about Exadata, he always starts his story with Exadata on OCI in the public cloud, then Exadata Cloud@Customer and only then on-premises. In other words, Exadata should be a key driver for OCI.

Exadata Cloud@Customer plays a very important role in this story, that should be obvious. Certainly in Oracle’s traditional target market for Exadata, people are still quite cautious about the public cloud. That makes Cloud@Customer an interesting intermediate step. Oracle likes to cite Deutsche Bank as an example. This is, in the words of Van Grieken, a ‘mega Exadata customer’, who until recently had it all on-premises. The goal of Deutsche Bank now is to migrate thousands of databases to Exadata Cloud@Customer. This involves more than 95 percent of the systems. So that includes all the mission critical systems for trading, payment processing and risk analysis, to name a few.

The first of many

Van Grieken expects many more to follow after Deutsche Bank. Oracle also has a number of similar projects underway in the Netherlands, but he cannot say anything about this yet. He does say, however, that Oracle can also count large banks and, for example, telecom companies among its Exadata customers in the Netherlands. These could all potentially follow Deutsche Bank’s example.

The exact reasons for individual organizations to switch from on-premises Exadata to Exadata Cloud@Customer is always a bit of a guess. In general, Van Grieken does see that it’s often about things like TCO and, of course, the management piece. Good people to do the management in-house are hard to find, for example. Then outsourcing it to Oracle is attractive. This while giving organizations the feeling that they are still in control, because the databases are still inside their own buildings. Of course, that control is no longer 100 percent, but you can stipulate many things in the contract, Van Grieken says. As an example, Operator Access Control is important to mention here. This allows customers to determine when Oracle personnel can access Exadata Cloud@Customer in your building.

All in all, the future for Exadata looks pretty good, if we look at today’s announcement and listen to Van Grieken. Whether customers who purchase Exadata Cloud@Customer will actually make the switch to the public cloud is, of course, the question. This may be the goal for Oracle, but many organizations are certainly not ready for it yet. It remains to be seen if, and how quickly, this will change. Perhaps Oracle has set up a slightly too attractive alternative with Exadata Cloud@Customer. If an organization can spare the square footage for this and can afford it, then for the time being there doesn’t really seem to be a reason to switch to the public cloud. It’s going to be interesting to see where this goes from here.