You can say what you want about Oracle’s cloud strategy, but the company is not taking any half measures. It has made major investments in recent years, the results of which are already visible. We interviewed Richard Smith, EVP Technology & Cloud EMEA at Oracle, about this. What has Oracle already achieved and what is still to come?

The Oracle cloud is growing fast, that much is certain. In itself, that’s to be expected, considering that Oracle has been investing very heavily in that component for several years. In combination with the current cloud momentum, and the relatively modest position that Oracle had and to some extent still has in the cloud market, solid growth even makes perfect sense. Still, triple digit growth (Smith even talks about high triple digit growth) is definitely a good sign for Oracle. This growth, by the way, is not only in their SaaS offerings, such as Fusion Apps. Smith emphasizes that it is visible in all cloud areas. This means that components such as public cloud with OCI and Oracle’s Cloud@Customer portfolio are also experiencing substantial growth.

Expansion of cloud regions

Oracle is undoubtedly investing heavily in the cloud in its broadest sense. This may include new products such as Roving Edge, but also extensions to existing services, such as Fusion Cloud Procurement, the decision not to charge egress fees and the introduction of new generations of successful platforms, such as Exadata X9M.

Offering these kinds of products and services is not enough, though. Oracle understands this too. That’s why it offers Cloud Lift to switch to OCI for free, and free OCI training and certification exams. In the case of the exams, this is temporary; the training courses will remain free.

A final component that the cloud obviously relies heavily on is, of course, the infrastructure. After all, products and services have to be available. Otherwise customers will not be able to purchase them. In addition, Oracle has traditionally been very well represented in somewhat more heavily regulated markets. These are usually more skeptical of public cloud than many other organizations. With the introduction of the Cloud@Customer offering, Oracle is addressing the latter group. It allows you to run Exadata in OCI within the four walls of your organization. However, you can also have Oracle set up and manage an entire OCI cloud region in your data center. Oracle calls the former Exadata Cloud@Customer, the latter is Dedicated Region Cloud@Customer.

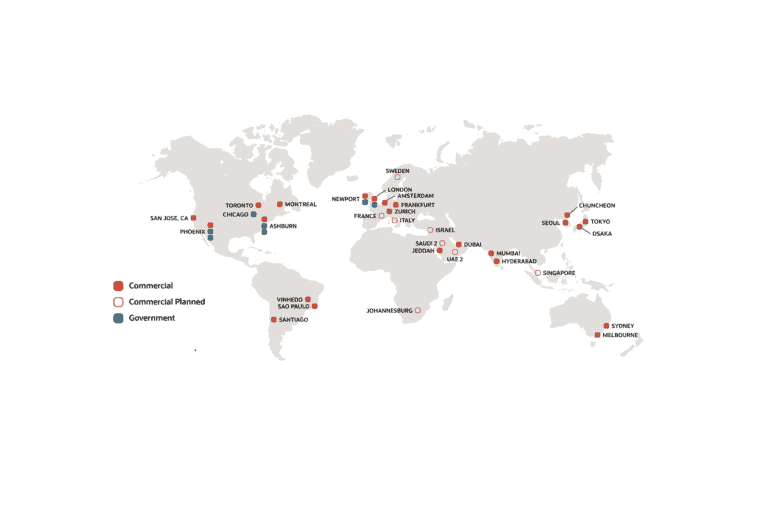

Besides the Cloud@Customer offerings, Oracle also needs to expand its public cloud offering. The company was relatively quiet on that subject in 2020, until a couple of weeks ago, when the company announced that it plans to open 14 new cloud regions by the end of 2022. This is part of a larger goal for Oracle, its so-called Dual Region cloud strategy. This means that Oracle wants to eventually have at least two cloud regions in almost every country where it operates.

Customer demand fuels investments

Oracle doesn’t really have a choice when it comes to investing in its cloud offerings, Smith points out. “The reason we’re adding new cloud regions is very simple: customers are asking for it,” he summarizes. That justifies the substantial investments in Capex (in the form of the new data centers) in the longer term, he reasons. Ultimately, this is a good example of economy of scale. Customers are eventually going to get more and more value out of the services and ask for more, but the offering has to scale with them.

The expansion of the number of data centers/cloud regions in Europe is a good example of customer demand, Smith points out. Compared to the US, for example, Europe is much harder to cover from one or a few central cloud regions. This is partly due to data sovereignty, or the desire to keep data within specific (country) boundaries. If you do not have a broad enough presence, then you are not interesting to many organizations, especially in more heavily regulated market segments.

In principle, even before the announcement of its major expansion into cloud regions, Oracle already had offerings for situations involving data sovereignty. After all, the Cloud@Customer offering addresses this as well. One might think that this would get in each other’s way. However, when we ask Smith about this, he indicates that he sees it differently. The two cloud offerings are interesting for different types of customers. Cloud@Customer is not the public cloud, of course; customers have much more control over that than they do over OCI. In the case of Deutsche Bank, which is transferring 95 percent of its databases to Exadata Cloud@Customer, this means they retain “absolute data sovereignty,” in Smith’s words. In other words, the control plane and the data plane are very strictly separated.

Generation O off to a good start

In a previous article, we talked about Generation O, a new initiative by Oracle to attract new types of employees. With Generation O, Oracle wants to attract talent at the beginning of their career. Participants in the programme are given the opportunity to get to know the entire Oracle portfolio over a period of nine to twelve months. On this basis they can choose what they want to do and in which region. The program is off to a good start, Smith tells us. The first group of more than 200 people has already started and the next group will start later this year. Oracle’s goal is to onboard at least 500 people per fiscal year through Generation O. They are well on track to reach that goal in the first year of the programme.

Not naive, multi-cloud is reality

If you listen to Oracle during the year, you might sometimes get the idea that they have a lock-in strategy. The company believes that OCI and the offerings derived from it, such as Cloud@Customer, are fundamentally better than the competition’s offerings. In a recent earnings call, Oracle CEO Safra Catz underscored that as well, citing an independent ranking on CloudWars in which Oracle had leap-frogged Google. OCI gets a higher total score than GCP. That overall score consists of all sorts of components, including things like security and reliability.

Despite Oracle’s conviction that OCI is superior in many areas, the company is also not naive, Smith indicates. “Customers have options and should have them,” he summarizes. Few customers go all-in on a specific environment. Hence, interoperability between Oracle’s offerings and those of its competitors is an important part of Oracle’s cloud strategy, he indicates.

Interoperability

Perhaps the best example of interoperability is the strategic partnership with Microsoft. With this, the two cloud providers link their data centers in certain cloud regions (where both are active, such as Amsterdam) with a high-speed interconnect. At Microsoft Azure we talk about ExpressRoute, at Oracle OCI about FastConnect. The idea is that customers can continue to run specific applications on Azure, for example, but can access the databases directly in OCI. This saves a lot of migration headaches and also does not create a lock-in. Some time ago we wrote a case study (in Dutch) about this interconnect.

In addition to what you might call ‘big picture’ interoperability, however, there is also a somewhat smaller-scale version. A good example of that is MySQL HeatWave. With HeatWave you can greatly accelerate queries in MySQL. This so-called accelerator works in parallel and in-memory. According to Oracle, it is also much faster than what the competition has to offer. It is so fast that you can run OLTP and OLAP workloads directly from the MySQL database. So you don’t have to use a dedicated analytics database in between. Until recently, however, you could only use HeatWave on OCI. That has been changed at the request of customers. You can now also use it in other cloud environments.

Staying innovative

With things like additional regions and more interoperability, Oracle is again making strides in the market. However, this does not mean that Oracle is there yet. In order to maintain the triple-digit growth it is currently achieving, it will have to continue to innovate. And that is certainly going to happen, Smith indicates. There is still a lot to come, he assures us.

As we see it, Oracle’s cloud focus seems to primarily be on existing customers at the moment. That is, Oracle has many large customers, many of which in heavily regulated segments, that it can still bring towards the cloud. This is undoubtedly very interesting, because in doing so Oracle is not only modernizing its customers, but also itself. The percentage of cloud revenue (SaaS and IaaS) grows, and with this legacy becomes less important. At the end of the day, that’s a good thing for Oracle as a company.

A good example of modernizing existing customers is Deutsche Bank, briefly discussed above. But Oracle has also recently signed agreements with companies such as Telefonica and Telecom Italia. Both are large organizations, and existing customers who are already heavy users of Oracle technology.

With every additional cloud region Oracle opens, it taps into a large potential for cloud among existing customers. That makes initially focusing primarily on existing customers a no-brainer, as far as we’re concerned. So many organizations already use something from Oracle’s porftolio, it wouldn’t make sense if they hadn’t been the first target group.

More new customers, products and services?

Of course, Oracle also needs to make sure it is signing up new customers for its cloud offerings. This is certainly happening now, Smith says, but we wouldn’t be surprised if there is still room for improvement and therefore for extra innovation. For example, if Oracle wants to appeal more to the developers within organizations, there is still a lot of work to be done. In the area of application development we don’t hear Oracle or OCI a lot when we talk to organizations and end-users in the market.

In short, there is still plenty of work to do for Oracle. Based on what we hear from Smith, Oracle isn’t going to stop investing and growing anytime soon. So we can expect a lot more in the future, especially once all the infrastructure basics are in place. We are particularly curious how Oracle is going to attract more new customers to their cloud platform. Will that be via the SaaS route, or will it take the IaaS route? Interesting times ahead, that’s for sure.