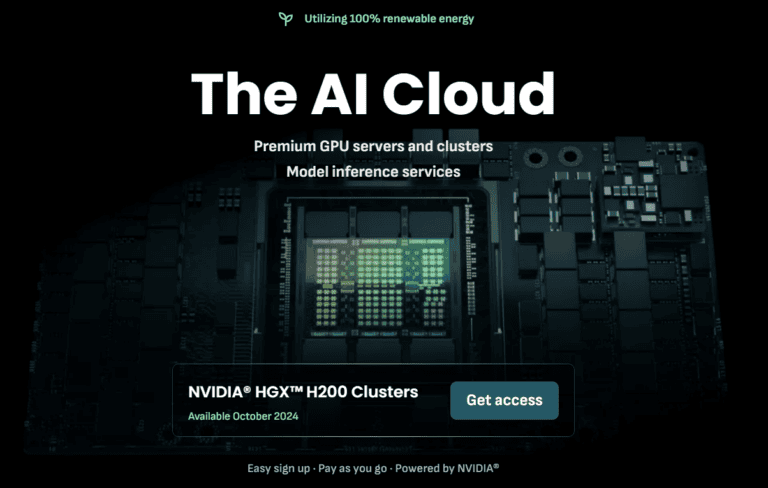

Europe has a glaring shortage of AI compute. Finland’s DataCrunch wants to solve it, and in a sustainable way.

AI compute mainly requires mountains of GPUs. These are in short supply all over the world, resulting in astronomical prices. This makes it attractive to hire this computing power temporarily, even if you’re specialized in AI models. For European companies, this is proving quite difficult, to the annoyance of Mistral, for example. To train language models, which regularly takes weeks or months for each model, companies must outsource to the major public cloud players or “AI hyperscalers” such as CoreWeave. All of which are US-based.

Also read: Why Cisco is interested in AI success story CoreWeave

DataCrunch: European AI hyperscaler

DataCrunch is the odd man out. It has bought numerous Nvidia chips and then rents them out on an hourly basis. This business model, known as GPU-as-a-Service, has a handy advantage. Speaking to TechCrunch (unrelated to DataCrunch), CEO Ruben Bryon explains that the mass-purchased chips simply act as collateral for loans – if the company goes bankrupt, banks simply pick up the GPUs.

Leasing is done in the same surge pricing manner as cab service Uber, with variable costs depending on demand. The customer base is very diverse, from tech companies like Sony and NEC to individual AI researchers who just need a quick burst of AI firepower.

The elastic model makes it easy to invest in the latest AI equipment, such as the Blackwell GPUs that OpenAI and Microsoft, among others, are also coveting. We do suspect that this requirement for constant innovation leaves little room for many major players: after all, the fastest, newest GPUs are also always the most efficient and therefore the cheapest in terms of TCO. Due to the very limited supply of this state-of-the-art hardware, not everyone can cough up the hefty sums.

European values

DataCrunch’s European character is evident in its emphasis on sustainability. For example, the data centers in Helsinki, Finland use renewable energy, while one of them gives heat back to Helsinki itself. The colocation in Iceland also runs entirely on green power. DataCrunch’s growth trajectory should eventually take the company beyond these colocations toward fully owned data centers. However, these will continue to reside in the north, as the company says it’s more likely to build a location in Canada than elsewhere in Europe.

A European alternative to established U.S. players is very attractive on more fronts. Recently we wrote about Schwarz Digits, the ’boutique’ hyperscaler grown out of Lidl to serve European players such as SAP and Bayern Munich. Like DataCrunch, it appears that there really is still a gap in the market on the continent for a cloud player of note; it’s just uncertain who that will be.

Also read: European alternative to AWS, Azure and Google was born inside Lidl