Oracle lost nearly 8% on Dec. 9 after it reported quarterly results that were slightly below expectations and gave the company a weaker outlook than analysts had predicted.

This reports Business Insider. The software vendor reported revenue of $14.1 billion in the second fiscal quarter, up 9% year-on-year. It posted earnings of $4.21 billion, or $1.47 per share, for the three months ended November. Oracle’s cloud services division, with customers such as OpenAI, xAI, and Nvidia, grew 12% from last year and accounted for 77% of the company’s total quarterly revenue.

Oracle expects revenue growth between 7% and 9% for the current quarter, bringing revenue expectations to about $14.3 billion, below analysts’ estimates of $14.65 billion.

The company’s growth is driven by the demand for computing power from artificial intelligence applications looking to train their models. Oracle’s shares have risen 80% this year, growing its market value from less than $165 billion at the end of 2022 to more than $500 billion.

Lagging order book growth

Investors are also likely to react to mixed results. Key factors include capital spending, which was higher than expected; infrastructure-as-a-service growth, which was in line with expectations; and order book growth, which fell short of forecasts. Oracle competes in the cloud infrastructure market with Google, Amazon Web Services, and Microsoft. “Our cloud is faster and cheaper than other clouds,” said Oracle CEO Safra Catz. “We remain the preferred cloud for AI workloads.”

Collaboration with Meta

This week, the company also announced a partnership with Meta to use Oracle’s AI cloud infrastructure to develop the social media giant’s Llama AI models.

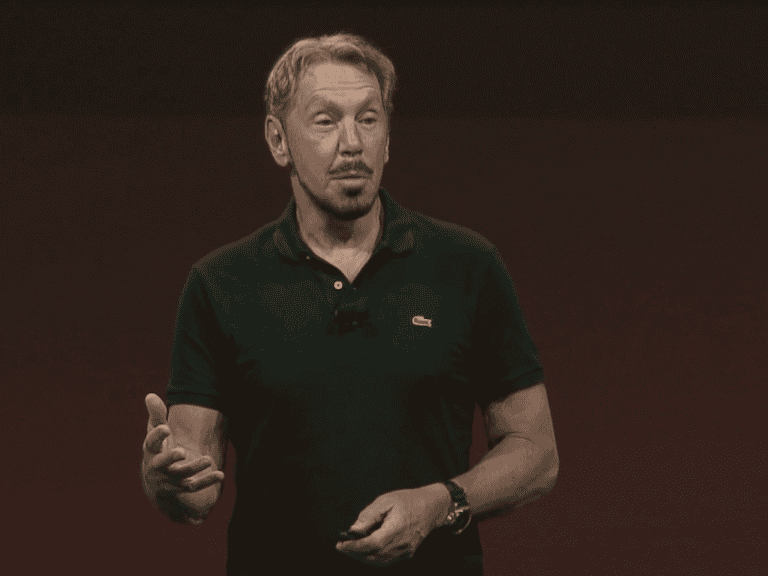

This year, Oracle’s rising stock price has significantly increased the wealth of Larry Ellison (pictured), the company’s co-founder and chief technology officer. His Oracle shares – he owns more than 40% of the company’s stock – place him third on the Forbes Real-Time Billionaires List, with assets of $234.8 billion on Monday.