Nvidia is exploring the possibility of significantly expanding production of its H200 AI chip as demand from China rises sharply. That country will be allowed to import this GPU from February onwards due to the lifting of restrictions from the US. According to sources, the company has held talks with chip manufacturer TSMC to free up additional capacity, as current stock is far from sufficient to meet expected orders.

According to Reuters, Chinese technology companies have collectively ordered more than two million H200 chips for delivery in 2026. Nvidia currently has a stock of approximately 700,000 units, including a smaller portion of GH200 Grace Hopper superchips. The majority consists of individual H200 versions. This gap between supply and demand is putting pressure on Nvidia’s production planning.

It is not yet clear exactly how many additional chips Nvidia wants to have produced, but according to insiders, the company has asked TSMC to prepare for upscaling. The expansion of production is expected to start in the second quarter of 2026. This fuels concerns about possible global shortages of AI chips, as Nvidia must continue to serve other markets at the same time.

The situation is particularly sensitive because Chinese authorities have not yet given final approval for the import of the H200. The US government has recently allowed exports to China again, subject to conditions, but Beijing is still weighing up whether access to these advanced chips could slow down the development of its own semiconductor industry.

Export ban is counterproductive

Nvidia says it continuously manages its supply chain and asserts that deliveries to approved Chinese customers will not have a negative impact on customers in other regions. According to the company, a total export ban would be counterproductive and play into the hands of foreign competitors, while China remains a market with strong local players.

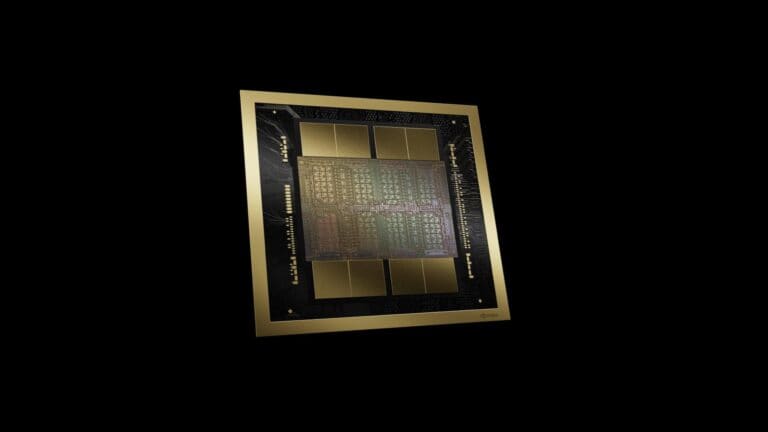

The potential additional order from TSMC would be notable, as Nvidia is currently focusing primarily on scaling up its newer Blackwell architecture and upcoming Rubin chips. The H200 is based on the older Hopper architecture and is manufactured using TSMC’s 4-nanometer process. Nevertheless, the chip remains attractive to Chinese companies because there is no equivalent alternative available locally.

Nvidia plans to make the first deliveries to Chinese customers from existing stock. The first shipments are expected to arrive before the Chinese New Year in mid-February. Major Chinese internet companies see the H200 as a significant performance improvement over the H20, an earlier, watered-down chip that was developed specifically for China but was later blocked.

According to sources, the price is around $27,000 per chip, with larger purchases and individual agreements influencing the final cost. Converted, a module with eight chips would cost approximately 1.5 million yuan. Although this is higher than previous alternatives, the price is considered attractive due to the significantly higher performance and the fact that gray market options are even more expensive.

Against this backdrop, regulatory uncertainty remains. Chinese policymakers are reportedly considering attaching conditions to imports, such as combining foreign chips with locally produced alternatives. In doing so, they are trying to strike a balance between access to advanced technology and protection of their own industry.

Also read: Nvidia writes off 5.5 billion dollars due to export restrictions