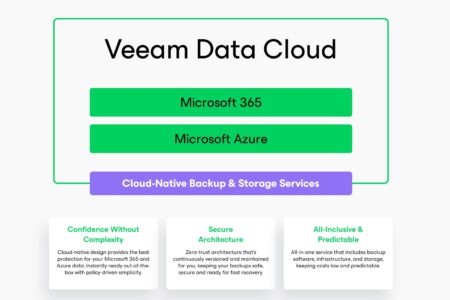

Public cloud infrastructure services like AWS, Google, and Microsoft have boosted the sales of data center hardware and software, increasing the profits of data center manufacturers like Cisco and Dell Technologies.

Over the past year, billions have been invested in launching new kits of data center products catering to servers, networking, storage, and software. In fact, cloud infrastructure accounts for almost 50% of all stored data globally, according to the Synergy Research Group. They also stated that data center infrastructure equipment revenue had crossed $185 million, capturing 47 percent of the market share.

Moreover, they also highlighted:

- This number is an all-time high

- 10% increase in spending

- Cloud infrastructure spending increased by 20%

Growing demand for cloud computing services

Tech giants are investing massively into cloud computing services, servers, and other gears to meet growing demands. As a result, cloud spending counterbalances the growth of enterprise data center infrastructure growth, recording a 3% increase that’s equivalent to $98 billion.

This trend is expected to continue in the upcoming five years, where cloud service providers will witness a double-digit increase in spending. However, Synergy Chief Analyst John Dinsdale disagrees.

“In the server segment of the market, unit shipments to public cloud providers have now far surpassed enterprise volumes, though the difference in the value of the two market verticals is much less pronounced due to higher enterprise server ASPs,” Dinsdale explained. “That gap in value will grow as public cloud server volumes continue to surge.”

The great thing about this is that top market leaders like Dell, Inspur Corp., and Microsoft own roughly the same market share as other cloud vendors.

In fact, most data center sales to public cloud providers were from design manufacturers such as Inventec, Quanta Computer, Foxconn, and Wiwynn. These individual providers account for the largest market share when joined together.