According to the new CEO of IFS, Mark Moffat, the company is phenomenal. He used that word several times in his opening keynote. Looking at the growth the company is experiencing, the term is perhaps justified. Last year saw a 33 percent growth in revenue, with cloud sales actually up a whopping 46 percent. To maintain that growth, the company invests in new technology and makes acquisitions on a regular basis. Important today for SaaS solutions and platforms is their AI strategy. At IFS, they focus on what they call “Industrial AI”. We understand the vision behind this, but we doubt it is enough. It is more or less an AI strategy with the handbrake on. That opens doors for competition.

IFS is an enterprise software vendor that focuses on several pillars with its cloud platform. The focus is on a combination of Enterprise Resource Planning (ERP), Enterprise Asset Management (EAM), and Field Service Management (FSM), but it is also specifically for six industries. IFS focuses on manufacturing, energy & utilities, construction & engineering, service industries, telecom, and aerospace & defense. We previously wrote that IFS combines best of suite and best of breed in one platform; in that article, we also explained the platform in detail. We also described IFS’ AI strategy earlier this year.

IFS is experiencing substantial growth and is successful because of its particular focus. Three major solutions for six industries with a vast customer focus and investment in industry knowledge. Moffat is the former Chief Customer Officer (CCO) at IFS and has more or less carried that role into his new role as CEO. During his keynote, he emphasized several times that they invest a lot in the relationship with the customer and what the customer desires. IFS also aligns the development of the organization with that. This approach already existed under the previous CEO. Two years ago, partly for this reason, there were almost exclusively customers on stage.

Specialization and acquisitions drive growth

IFS is a separate player in the enterprise software market because of its specializations. IFS focuses increasingly on the IFS Cloud platform on which their three leading solutions run. However, we should also mention that they still have a decent on-premises base that is not going away anytime soon. In fact, some customers need to run IFS on-premises. If that were no longer an option, they would drop out. For example, IFS provides asset management on aircraft carriers, where a connection to the outside world is not an option. In times of (cyber) war, you simply cannot depend on a cloud provider.

In recent years, IFS has experienced significant growth, on the one hand through increasing specialization in the six industries and, on the other hand, through strategic acquisitions. This year, Poka and Copperleaf, among others, were added to the portfolio. The latter is still very recent.

Poka

With Poka, organizations can help factory employees and people in the field work better, more efficiently, and more safely. Poka connects these employees through an app and cloud platform. With Poka, organizations can standardize their operations. Experienced employees can record how they perform their work or troubleshoot failures. Within Poka, other employees with less experience can learn from that. Organizations can even develop training for new or temporary employees to be more productive and efficient.

During IFS Unleashed, we spoke with organizations that use Poka and motivate their employees to do more with it. Some organizations reward employees who have successfully completed training by giving them a better position or a higher salary. An employee who works safely and is more productive is also worth more to the company. In addition, IFS customers argue that Poka also creates more bonding between staff and the organization.

Copperleaf

The acquisition of Copperleaf is a substantial investment for IFS. Poka was acquired for just under 200 million dollars, but for Copperleaf, IFS must pay a whopping one billion dollars. In return, however, it is a serious expansion of the IFS portfolio. Copperleaf offers the ability to do extensive analysis on data that then helps make strategic business decisions. Copperleaf naturally focuses on somewhat more long-term decisions. Think about investing in new markets, managing risk, or helping to measure and meet sustainability goals.

For Copperleaf, it doesn’t matter what kind of data is involved. It can process data and analyze it. Within Copperleaf, one can define how the application should read the data. Copperleaf already uses a lot of data from assets, but with the integration with IFS Cloud, much more data will become available. IFS wants Copperleaf to enhance its position as a comprehensive end-to-end asset lifecycle management solution provider. The goal is to give organizations real-time visibility into data so that problems and challenges can be detected and tackled early.

Copperleaf already manages $2.9 billion worth of assets. To date, every customer has recouped their investment in Copperleaf. The data Copperleaf can analyze and advise on allows for significant optimizations and efficiencies. As a result, billions of dollars can be saved annually. Maintenance costs go down, and reliability goes up. With real-time analytics, the value of Copperleaf becomes even more significant. Overall, it is a targeted investment, allowing IFS to embark on a new growth spurt. IFS seems to have its act together with the overall strategy.

IFS takes first steps with generative AI

All the major software vendors this year talk mostly about AI. For the past two years, the potential of AI has been constantly being discussed. Now that the AI hype is slowly blowing over, solutions with AI features become available, and we can evaluate where everybody is at and what AI will mean for software and organizations. IFS chooses to focus on what they call Industrial AI. It wants to use AI, algorithms, and machine learning to focus primarily on detecting anomalies and problems, automating schedules, and closing gaps in a supply chain. IFS mainly wants to develop AI that applies to the industries they focus on.

This focus on Industrial AI is not new. In fact, IFS and many other vendors have been doing this for much longer. This is a form of predictive AI, or what we also sometimes call traditional AI. The hype of the past two years has mostly revolved around generative AI, which, combined with predictive AI, can create whole new possibilities. This is also why everyone has jumped on this AI hype.

IFS Copilot chatbot

If we look at what IFS is doing now regarding generative AI, they are mainly betting on small use cases that appeal to a large group of customers and make work better and more efficient. As the CEO, Moffat, puts it, “We’d rather have 300 AI use cases used by 90 percent of our customers than 500,000 use cases used by 5 percent.”

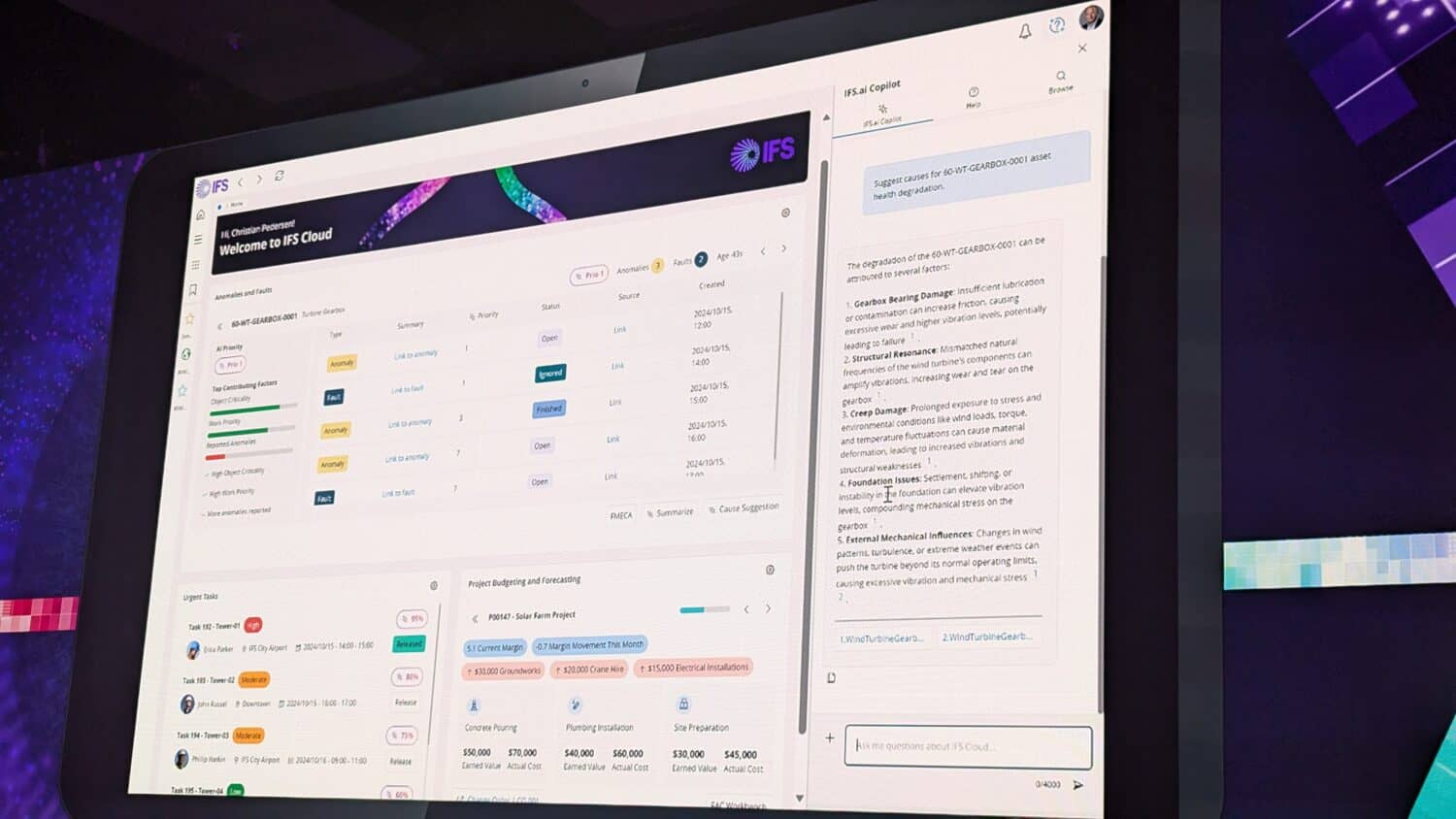

IFS has about 60 AI use cases rolled out and about 300 in development. According to Moffat, these use cases have been pre-tested with customers. IFS asks whether customers would like certain AI features and if they would use them, but also if they are willing to pay for them. These use cases are all reflected in the IFS Copilot chatbot. This chat window is on the right side of the screen, where people can ask questions to the IFS Copilot.

That’s already a significant improvement compared to some other systems, but compared to IFS competitors, it’s pretty minor. Many major SaaS players and competitors of IFS have already implemented so-called autonomous AI agents and offer capabilities to interact with AI by voice. They are also very busy enriching their datasets with context and metadata, thus widening the possibilities of AI.

IFS currently determines from the user’s screen what the context of a question posed to the Copilot is. That is a fairly limited way of adding context. Especially compared to competitors who have build a whole knowledge graph for their datasets.

IFS is still building infrastructure for advanced generative AI

In a conversation with Bob de Caux, the AI leader at IFS, we asked about the AI roadmap and how far along IFS is. He states that IFS’ customer portfolio is not eager to see many AI experiments, IFS’ customers want reliable AI functions and explainable results. For now, IFS is working with prompt engineering and RAG on top of the Azure AI Service to add AI features.

De Caux admitted that while they have more ambitions and plans on the roadmap, the underlying infrastructure to take AI to the next level is still being developed. IFS, like many other organizations, is developing a knowledge graph. A knowledge graph consists not only of data, but also of context where the data comes from, how it should be read and interpreted. Coupling AI with a knowledge graph makes the output much better and more reliable.

In addition, IFS is building what they call an assistant framework. This framework is already partly used to determine how to read a query, what context and data are needed, and what AI feature should provide the output. This is best compared to what other vendors call a “reasoning engine.” Once IFS is ready with the knowledge graph and its assistant framework is well connected to it, it will take the next step toward AI agents and proprietary AI models.

IFS will bet on more advanced AI use cases in the coming years

According to Caux, IFS is not ready for AI agents because the underlying infrastructure is simply not yet complete. However, it is on their roadmap, as is developing their own smaller AI models. According to Caux, IFS is already buying industry-specific datasets to start developing its own industry and domain-specific AI models. Experiments are already being done with these models.

IFS currently works with the Azure AI service and primarily uses OpenAI models. However, it is exploring Hugging Face’s AI models and other large models to see how it can take advantage of them. De Caux also hopes to start offering AI to its on-premises customers in a few years. This is also dependent on the development of the so-called small language models (SLMs) from the big known parties.

IFS is competing with the giants of the world, which is difficult

During IFS’ various presentations, the company proudly showed how it competes with the world’s biggest IT companies in ERP, EAM, and FSM. The quadrants and wave reports were displayed large on stage. However, competing with players such as Oracle, Salesforce, SAP, Microsoft, and a few others is not always easy. Just having the best product is not enough.

Having a narrow focus on six industries and offering only a limited number of solutions has allowed IFS to compete successfully with those big players in recent years. As a result, IFS has grown successfully. However, the rise of AI, specifically generative AI, could throw a spanner in the works.

Developing AI is expensive, and talent is scarce

Developing new technology, especially in AI, has never been more challenging than it is today. The knowledge needed is very scarce, the costs involved in developing AI features are incredibly high, and it takes many software developers to make the necessary infrastructure changes. The parties IFS competes with are not afraid to burn a few billion dollars on these AI innovations. IFS does not have that luxury.

IFS states in its presentations that it is working on AI but does not want to chase every hype. It also states that their customers are not open to it; they mainly want proven technology. Therefore, IFS says it’s cautious about AI features and use cases. In part, this suits IFS just fine and can be seen as an excuse because it does not have the capabilities and resources to develop AI as fast as the competition. On the other hand, AI adoption in general in the market is certainly not overwhelming yet, so there is some truth to what IFS is saying.

AI is not a hype that will blow over, it will set the new standard

There is quite a bit to be said about IFS’s explanation. As a software vendor, you shouldn’t follow every hype because you will make large investments with a poor return on investment (ROI). For example, IFS cited big data, a hype in which organizations have invested a lot but, in many cases, have seen little result.

However, as a software vendor, you should also assess when something is hype and when it sets a new reality or standard. AI has taken us by storm but is becoming available fast and setting new standards in various platforms and software companies. Competitors of IFS are investing hundreds of millions, or even billions, in AI.

Based on what we have now heard from IFS, as far as we are concerned, the company should try to step up its game. Otherwise, the company could well go from being ahead to being (significantly) behind. A reliable solution, a lot of customer contact, a good relationship, and industry knowledge are certainly strong qualities. Still, they are insufficient to keep up if you lose with AI. If a competitor’s solution can soon use AI to make employees work two, three, or four times as efficiently, the IFS customer will move to the competitor. Granted, that customer is generally not hugely progressive regarding new technologies. But if there is a lot of profit to be made or costs to be cut, that may start to change.

Eat or be eaten

IFS has evolved significantly in recent years. It has made good acquisitions that have strengthened its portfolio and accelerated its growth. It has shown substantial growth in several segments and grabbed market share. Nevertheless, we believe that IFS’ current AI strategy could cause this success to disappear as quickly as it has come. After all, it is an AI strategy with more or less the handbrake on. IFS needs to pick up the pace; the competition is betting heavily on generative AI, and IFS is already about a year behind. We see that as a considerable risk because IFS’s competitors are all from the big tech league. It’s eat or be eaten.