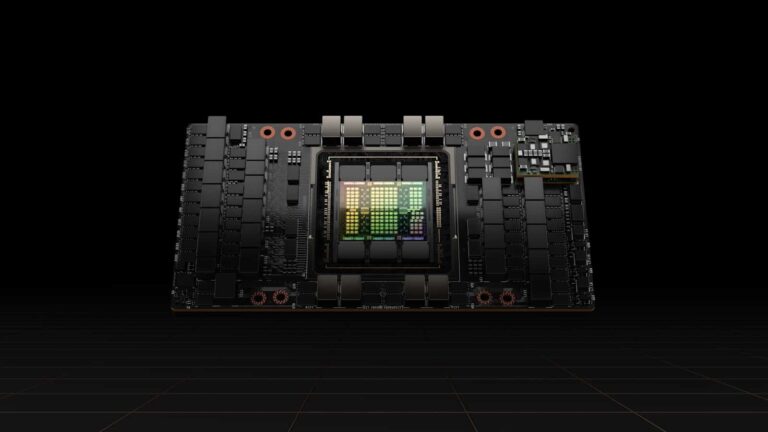

Nvidia can’t handle the demand for GPUs as it stands. TSMC cannot produce enough of the company’s H100 chips, so it appears Intel Foundry Services is coming to the rescue.

Sources within the chip industry state that the deal between Nvidia and Intel Foundry Services involves 5,000 wafers per month. Tom’s Hardware suggests that this could lead to 300,000 additional H100 chips per month, assuming the yield is virtually flawless and production is actually dedicated to said GPU.

This would significantly reduce Nvidia’s dependence on TSMC. At the same time, the deal would be a breakthrough for Intel Foundry Services, which has become an essential component of the Intel portfolio since CEO Pat Gelsinger’s appointment.

Hunting for AI hardware

Every major tech company is on the prowl for large quantities of Nvidia’s AI chips: Meta, for example, is targeting 350,000 new H100 processors this year. Currently, these GPUs are considered the ideal solution for AI acceleration: everything from R&D to the daily running of ChatGPT daily runs by far the fastest on the H100. In November, Nvidia also introduced the H200, which delivers a significant performance jump for AI workloads.

The capacity expansion won’t take place until the second half of the year, according to reports. Intel Foundry Services’ packaging methodology, known as Foveros, differs from TSMC’s so-called chip-on-wafer-on-substrate (CoWoS) approach. Currently, all current Nvidia chips are designed for the TSMC process. As a result, it isn’t yet clear which chips Nvidia can have Intel Foundry Services produce.

We’ve already heard from Intel that any IFS deals such as this one won’t receive an official confirmation. However, the news shows that an agreement can rarely remain secret for long.

Little opportunity for competitors

Earlier we illuminated that Nvidia is in a unique position. In terms of performance and infrastructure, it is hard for competitors like AMD and Intel to keep up. In practical terms, Intel Foundry Services is a separate operation from the Intel that designs and sells hardware to rival Nvidia, so partnering with the company won’t impact the competitiveness of Intel’s offerings. It does, however, allow Intel to at least benefit from the AI upsurge by other means. Meanwhile, AMD depends on TSMC for the success of its own AI chip MI300. Meanwhile, that company expects to realize $3.5 billion with it, an ambitious goal.

Also read: Do the AI promises from Microsoft, Google and AMD pay off?