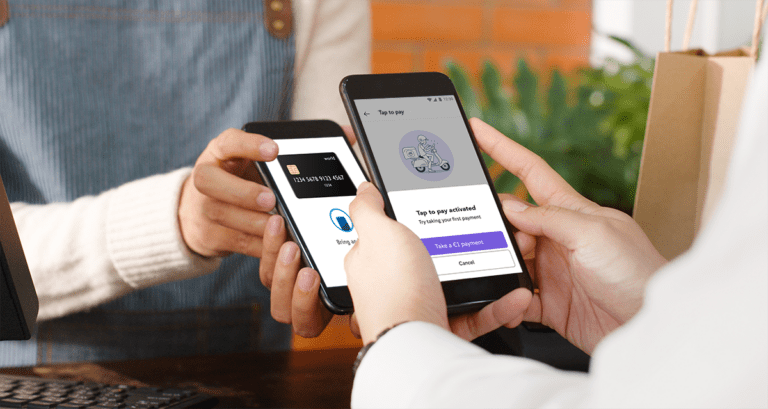

PayPal Tap to Pay is now available in the Netherlands, Sweden and the United Kingdom. The Android app allows smartphones to accept card payments.

Tap to Pay uses the NFC chips of Android smartphones and tablets to support card payments. Think of credit cards, debit cards, and digital wallets like Apple Pay.

Five years ago, no retail or hospitality business could do without a payment terminal. The emergence of mobile NFC technology is changing the market. Modern smartphones contain NFC chips for wireless communication among devices. PayPal Tap to Pay hooks up to NFC chips, after which a smartphone or tablet allows card payments.

The app is currently only available on Android in the Netherlands, Sweden and the United Kingdom. A spokesperson for PayPal said that availability may expand over time.

Tap to Pay is part of PayPal’s Zettle Go-app. To use the solution, download the app via the Play Store. You can directly accept payments by entering an amount and tapping a customer’s payment card on the back of the smartphone. As mentioned above, digital wallets on smartphones, smartwatches and tablets are supported as well.

Strategic move

The app was developed by Zettle, a subsidiary of PayPal. Zettle is known for payment systems and terminals. The launch of Tap to Pay is an important strategic move. NFC chips promise to replace traditional payment terminals in the short term. Zettle, which has traditionally sold payment terminals, is turning to an emerging market at the right time.

Trouble in Brussels

In early 2022, Apple announced that a Tap to Pay solution for iPhones is underway. The release date is unknown. Stripe, an Apple partner, will be the first provider. At first, the app will only be available in the United States.

Strikingly, PayPal’s version is exclusively supported on Android. Apple does not make the NFC chips of iPhones accessible to everyone. Some parties, including PayPal, are blocked. That doesn’t sit well with the European Commission.

The Commission recently warned Apple about monopolizing NFC functionality. According to the Commission, Apple may be violating antitrust laws. iPhones are so widely used that it may prove illegal to refuse competitors’ mobile payment systems. On May 2, the Commission requested a statement from Apple. Resultingly, a criminal investigation may arise.