Appian has released its Automation Maturity Index. This tool allows companies in the financial sector to investigate how their use of automation compares to other large companies.

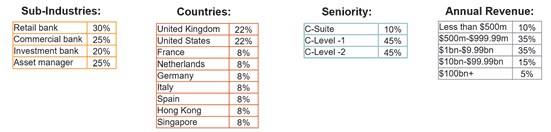

The tool is based on a survey that Appian conducted in conjunction with Longitude, a Financial Times company. 500 C-level executives worldwide were asked to what extent their companies use automation and what the results are. An overview of the origin of the various respondents is given in the table below.

Leaders, mainstream and laggards

Respondents to the survey were divided into three groups. The “Leaders” are the companies in which automation is already applied innovatively and at a high level. “Laggards” say that most of their automation has no added value and the “Mainstream” group is somewhere between these extremes. The latter group comprises 65 percent of the participants.

Cost savings and competitive advantage

Of the leaders in banking automation, 98 percent reported significant cost savings as a result of their investments in automation. Among the laggards, this is only the case for 7 percent. Also, 98 percent of the leaders see a “significant” competitive advantage through automation, compared to 6 percent of the laggards.

Increased use of RPA

The use of Robotic Process Automation is also increasing, especially among the leaders, where this is the case in 70 percent. Of the mainstream respondents, 44 percent are still in the pilot phase of implementation. Furthermore, almost all of the leaders have a centre of excellence for their automation strategy, while 81 percent of the laggards are struggling to prioritise automation projects.

According to Appian, there is no one-size-fits-all route to automation excellence. However, the leading companies show in the survey that they are able to seamlessly integrate people, AI, RPA, workflows, databases and systems.

Correlation between format and automation

“There is a strong correlation in the survey data between the size of an organisation and the maturity of its automation,” said Mike Heffner, Vice President of Solutions and Industry Go To Market at Appian. “The world’s largest financial services firms are understandably at the forefront of the transition to automation, and the progress they are making can help the entire industry. But size is not the whole story. We see a huge gap between leaders and laggards, as well as a large majority falling into the mainstream across all sub-categories of the industry.”

Companies interested in how they compare to those surveyed can go through an Automation Benchmark Maturity Tool on Appian’s website. Part 1 of the survey can also be read back there.