Nearfield Instruments, a Dutch company specializing in advanced measurement equipment for the semiconductor industry, is planning to go public in 2027 or no later than 2028. CEO Hamed Sadeghian announced these plans amid growing demand for their measurement technology, driven primarily by the AI boom in the chip industry.

Sadeghian revealed the plans in an interview with Reuters. The Rotterdam-based company, which counts Samsung among its clients, already announced this week that it has received multiple orders from a U.S. customer. Additionally, the company intends to open offices in the United States.

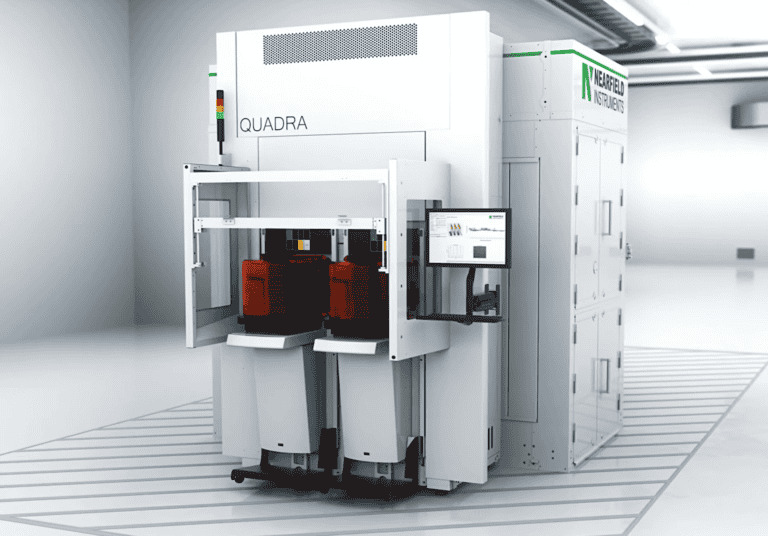

Innovative Measurement Technology

Founded in 2016, Nearfield Instruments raised €135 million in July from investors, including Walden Catalyst and Singapore’s sovereign wealth fund, Temasek. The company employs atomic force microscopy to measure silicon wafers, allowing it to work with dimensions smaller than most wavelengths of light. This enables Nearfield’s equipment to detect defects in chip manufacturing processes, ideally at an early stage.

Previously, Nearfield Instruments secured €17.5 million in 2021 and €27 million in 2023. At the end of 2023, the company also received government subsidies for further development, with the then-Rutte IV cabinet allocating €230 million to Nearfield, NXP, and ASML.

Expanding Applications

While the technology is primarily used for advanced processors, the company is also seeing growing interest from memory chip manufacturers and producers of older chip generations in the automotive and telecom sectors.