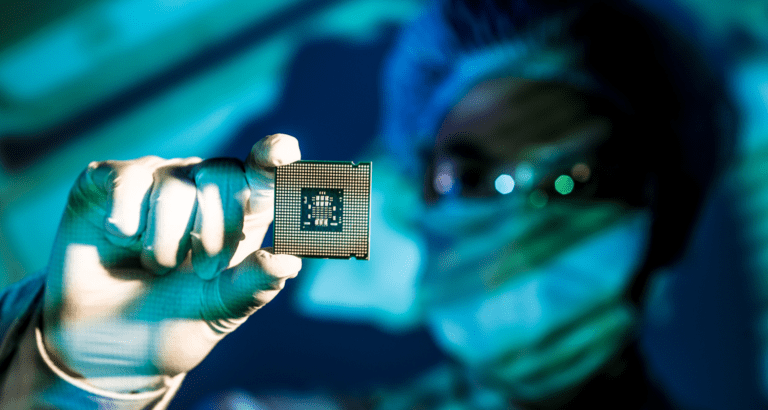

Intel, the world’s largest chip vendor, is about to lose its leading position. In Q2 and Q3 of 2021, Samsung generated the most chip revenue worldwide. Fourth-quarter results will be released at the end of the month. Everything indicates that Intel is slipping to second place.

Investors seem to have already processed the news. Intel’s market value is estimated at 226 billion dollars (199 billion euros). Samsung peaks at 447 billion dollars (393 billion euro). Nvidia has a value of 692 billion dollars (608 billion euros) and Taiwanese chipmaker TSMC is estimated at 670 billion dollars (close to 590 billion euros).

Although Intel has seen better years, its annual performance is no laughing matter. In each quarter of 2021, the organization turned over between $18 billion and $20 billion in chips. In Q2 and Q3, Samsung gained a lead of several hundreds of millions. Intel remains responsible for most of the computer processing we depend on to work and live. Still, the disadvantage weighs heavily.

For the past 30 years, Intel has dominated the chip industry. Intel’s board is fighting tooth and nail to revive the golden age. In 2021, Pat Gelsinger — a professional with 30 years of experience under the company’s belt — took office as CEO. He was present when Intel was unbeatable. Who better to lead the charge in trying times?

Investors were excited about Gelsinger. The share price rose — and fell with the lapse of the past year. Intel wants to compete with distinctive technology, but the market isn’t known for its patience. Developing semiconductors, equipment for mass production and new factory facilities takes years. Intel is too late.

The pressure

Gelsinger is expected to spend the next year straightening out the questionable choices made by his predecessors. The stakes have seldom been this high. While Europe and the United States are facing unprecedented chip shortages, Eastern competition is growing rapidly.

Gelsinger sought support from the US government through a multibillion-dollar injection for the construction of chip factories in the United States. For the same purpose, Intel is pumping 80 billion euros into Europe. There’s plenty of initiative, but results are lacking. Talks with the US government are proceeding at a snail’s pace. Though the building plans for Europe were drawn up, the first piles have yet to be driven into the ground.

Gelsinger’s leadership gives hope, but the disadvantage seems too great. Intel has failed to catch up with competitor innovations. For that, it’s paying the price.