Cryptominers are a bigger source of revenue than Nvidia cared to admit.

The US Securities and Exchange Commission (SEC) supervises markets in the United States. The SEC enforces several laws, including rules on communications between shareholders and organizations. Organizations must communicate honestly and transparently about sources of revenue. This allows shareholders to fairly consider whether to invest in an organization. Nvidia failed to comply.

In its 2018 quarterly results, Nvidia presented revenue from cryptominers in the ‘gaming’ category. A deliberate choice, as revenue from cryptominers is relatively unreliable. By misappropriating its revenue, Nvidia hoped to increase the trust of shareholders. An illegal offence, concluded the SEC in a recent investigation. The market authority imposed a fine of 5.5 million dollars (approximately 5.2 million euros). Nvidia announced that it will be complying and paying the fine. Although the organisation refuses to acknowledge the accusations, actions speak louder than words.

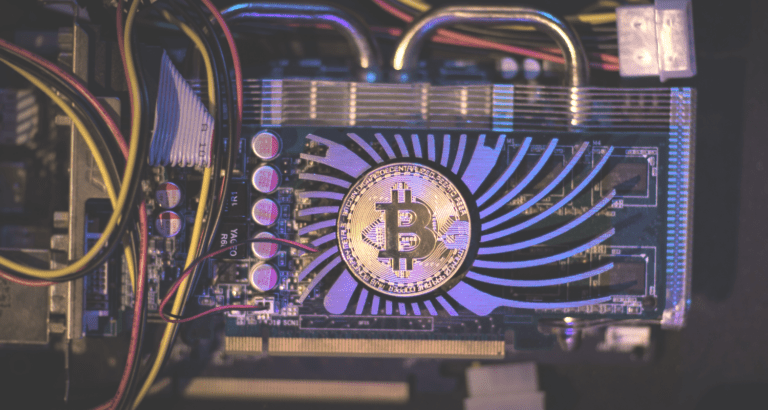

Nvidia and cryptominers

GPUs are excellent for repetitive tasks. That’s why Nvidia’s models are regularly bought by cryptominers. They receive a reward for performing calculations for blockchains. The more computing power, the bigger the spoils.

Resultingly, Nvidia earns revenue from cryptomining. Nevertheless, the organization is trying to distance itself from the market. First of all, Nvidia doesn’t always have enough chips and production capacity to serve every customer. Every GPU bought by a cryptominer is one less GPU for business customers and other consumers. Second, some investors aren’t interested in organisations with unpredictable revenue streams. Whenever Nvidia is branded as a service provider for cryptominers, it risks shareholders dropping out.

The dilemma has multiple solutions. Among other things, Nvidia tries to deter cryptominers with product modifications. The optimal GPUs for mining Ethereum (cryptocurrency) have a high Lite Hash Rate. Nvidia limits the Lite Hash Rate of some models to discourage cryptominers.

The measures are successful, but not always at the desired time. At the end of 2017, cryptominer sales increased significantly. Nvidia preferred not to tell investors, because as mentioned earlier, some shareholders have little faith in the sustainability of cryptomining. Hence, the organisation decided to categorize the revenue as ‘gaming’, and will be fined accordingly.