According to the Financial Times, the UK government is considering using national security legislation to force Arm’s IPO in London rather than New York.

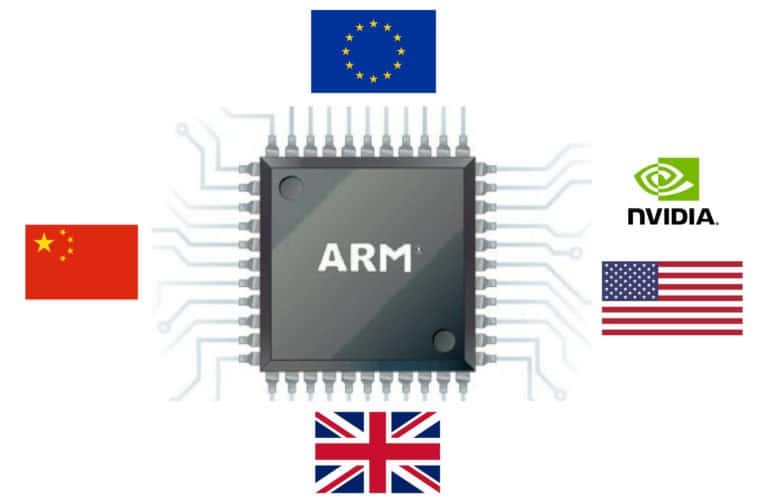

Arm is a major processor designer owned by SoftBank, a Japanese organization. SoftBank tried to sell Arm to Nvidia, but authorities blocked the deal in 2022. Now, SoftBank intends to list Arm on a stock exchange.

SoftBank is keen on an initial public offering (IPO) in New York, but the UK — Arm’s country of origin — is pushing SoftBank to list Arm in London. Two people familiar with internal government discussions told The Financial Times that the government considers using national security legislation to force a London IPO.

It might be a ruse

The UK recently deployed the National Security and Investment Act. Although the new rules can’t prevent SoftBank from listing Arm on the New York Stock Exchange (NYSE), the government could intervene when a foreign company takes a significant stake after the listing. At that stage, the government can attempt to block the transaction.

There’s no guarantee that the government would be successful in doing so. A person familiar with ongoing talks at SoftBank said the organization is aware of the government’s plan, and considers it to be a ploy to push Arm towards a London listing. It’s possible that lobbyists are intentionally spreading rumours to influence SoftBank’s decision.

It’s still up in the air

It will be a few months before SoftBank must choose a listing venue. The organization may opt for a dual-listing. According to The Financial Times, this would be considered a victory for the UK, which has lost some of its appeal to technology businesses due to Brexit and government policy.