Recently Red Hat held its annual conference, this time online because of the coronavirus. It was the first major conference with the new CEO, Paul Cormier, and under the wing of IBM. They immediately made clear Red Hat is communicating in a different way now, whereas Red Hat used to position itself more in the background as an introverted technical player, it’s now more extroverted with bold statements. It doesn’t shy away from the competition.

The acquisition of IBM, also known as Big Blue, seems to have done Red Hat well. At least for people like us, who analyse and report on developments in enterprise IT. We like it when a company dares to say what it stands for or want to achieve, instead of a series of meaningless quotes about digital transformation. We have more than enough of those. The atmosphere and drive at Red Hat are undiminished, and with this mentality, they can move mountains. Red Hat has been given wings by the acquisition of IBM, and maybe it’s in the name Red…

Red Hat gives you wings…?

Of course, it remains to be seen how this giant acquisition will turn out and whether the company will suffer as a result. Red Hat has been part of IBM for almost a year now and has benefited a lot from the acquisition. That’s what Werner Knoblich, senior vice president and general manager EMEA at Red Hat, told us during an interview. He states that Red Hat will be able to develop and scale up faster under the wings of IBM. Also, IBM ensures a significant increase in sales.

Red Hat is still independent under the wing of IBM and is working together with all players in the market. Even with IBM’s major competitors, such as Amazon and Google. All the products Red Hat introduces to the market are and will remain open-source. That strategy hasn’t changed, it’s been around for 20 years, and it’s still standing. What has changed, however, is that IBM has changed its own portfolio. Where IBM used to develop its own products or chose different solutions to implement new services, IBM has now decided to base everything as much as possible on Red Hat OpenShift.

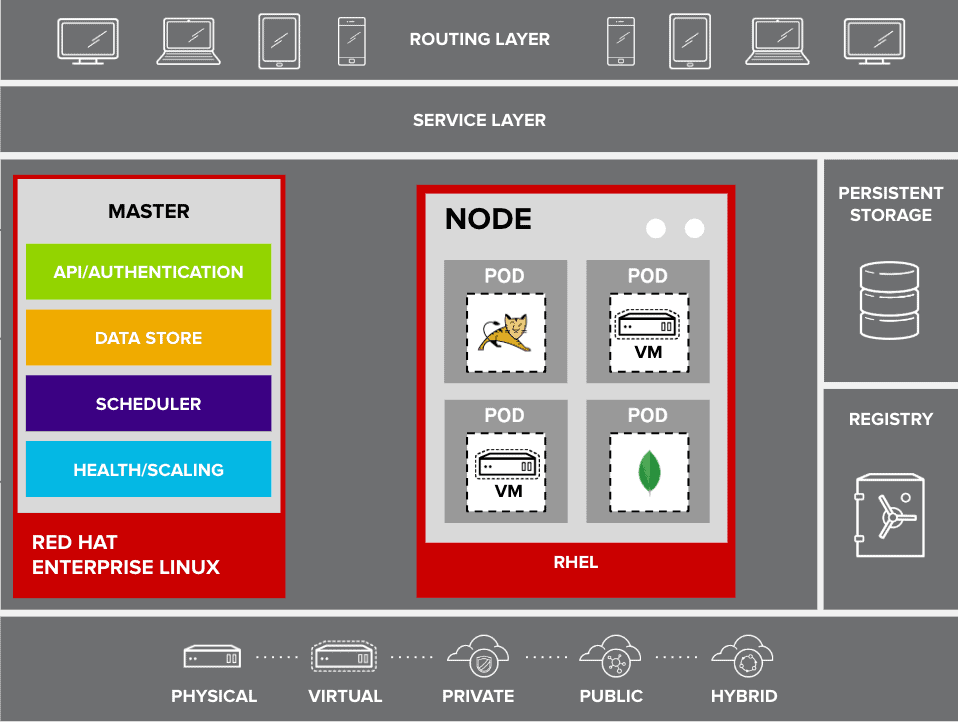

This ensures that OpenShift gets a lot more attention and traction. Especially in the enterprise market, where IBM does a lot of business. This is among the reasons for the increase in sales at Red Hat. Companies now get in touch with OpenShift faster and more often. For example, IBM Cloud Paks is IBM’s solution for companies that want to migrate to an open hybrid cloud, entirely based on OpenShift. With Cloud Paks, companies get a solution that allows them to run Kubernetes containers wherever they want. Enterprise-grade OpenShift in the cloud or on-premise, possibly combined with open-source OpenShift. All according to IBM and Red Hat’s best practices.

Knoblich states that Red Hat is even emerging in IBM’s mainframe portfolio. IBM used to work a lot with Suse for this portfolio, but currently, Red Hat Enterprise Linux (RHEL) is gaining ground very fast.

All eyes on OpenShift

Of all the products in the Red Hat portfolio, OpenShift probably has the most potential. Of course, RHEL acts like a common thread through all solutions and is also an essential product, but it’s OpenShift that offers enormous commercial opportunities.

During the virtual conference, version 4.4 of OpenShift was presented with several new features and a preview of what is coming soon. One of the important new features is Red Hat Advanced Cluster Management for Kubernetes. This makes it possible to manage multiple OpenShift Kubernetes clusters from a single pane of glass. You can switch directly between different clusters, making management much easier and faster. It also doesn’t matter where these clusters are running, whether it’s on-premise, in the IBM Cloud or at AWS, Google or Microsoft Azure. According to Knoblich, this is an important announcement. Advanced Cluster Management is still in preview but should be available this summer.

IBM fully supports Red Hat’s strategy.

According to Knoblich, this is also proof that IBM fully supports Red Hat’s strategy and leaves it intact. The technology behind Advanced Cluster Management originates from IBM. Red Hat had something like this on the roadmap but was far from ready. The open-source giant needed at least another year. IBM had been developing this for a long time and was already much further ahead. The technology was transferred to Red Hat where engineers from IBM and Red Hat developed it further. However, it also means that Red Hat Advanced Cluster Management for Kubernetes will become available as an open-source product, according to Red Hat’s strategy.

Virtual machines in OpenShift

Another important feature Red Hat is working on is the integration of virtual machines (VMs) into OpenShift, called KubeVirt. Where other parties choose to provide their virtual machine platform with Kubernetes support, Red Hat reverses it. With KubeVirt, it is possible to run a VM within a Kubernetes container, so that it can run next to all containers. Ideal for legacy applications that are not yet suitable to run entirely in containers. Another unique feature of KubeVirt is that the VMs are persistent and not stateless. Adjustments can easily be made to the VM without the VM discarding these changes. Something that is not possible with containers by default, only via externally linked databases or persistent storage.

Mass competition with Kubernetes

Kubernetes has conquered the world in recent years, but this has also meant that more people have jumped on the Kubernetes bandwagon and the competition gets bigger and bigger. Knoblich acknowledges this, as does the new CEO of Red Hat, but both make bold statements. VMware, for example, is seen as the biggest competitor because it is the market leader in the VM world and many companies switch applications from VM’s to containers. In addition, VMware has also developed a multi/hybrid cloud strategy based on Kubernetes with Tanzu. About VMware, Knoblich says: “VMware now has three Kubernetes platforms that they are trying to squeeze into one. It is a closed and dedicated environment, and the integration of Kubernetes leaves much to be desired. We have a totally different approach.” He continues: “On top of that, we now have over 1.700 customers and more than 100.000 cores running with Kubernetes, and VMware has yet to get started. But they are our biggest competitor.”

In addition to VMware, we also cited Google because Google is the creator of Kubernetes and ultimately donated it to the open-source world. Google also develops various managed services based on Kubernetes under the name Google Anthos. With Anthos, Google wants to offer companies the possibility to run Kubernetes containers in any cloud and on-premise, all centrally managed with Anthos. Google is also working on the ability to migrate VMs to containers or otherwise support them with Anthos. This strategy is very similar to that of Red Hat, except Anthos is not open-source.

Knoblich says the following about Google: “They are not credible, a large public cloud provider that bets on a multi-cloud world with all its competitors. They are forced to support hybrid cloud because customers want it, not because they themselves want to do so. They will never fully support a competitor.”

Clear statements and there is a truth in them. The question is ultimately what the customer chooses. The fact that VMware, with Kubernetes support in vSphere, is taking the opposite route and then there is also Tanzu. Currently, they are lagging behind Red Hat in terms of sales, but that doesn’t mean that it will stay that way. VMware is a large player with a large customer base, which can quickly scale up and grow massively.

As far as Google is concerned, there’s also some truth in that. Google does support AWS and soon also Azure, but Google mainly pushes a variant of the Google Kubernetes Engine on top of bare metal from AWS or Azure. You can also link a managed Kubernetes service from AWS or Azure to Anthos, but then the features are limited.

Red Hat is going strong for now, with bold statement, but will it stay ahead in hybrid cloud or will others catch up and in the end beat Red Hat. Let’s see if they have the same bold statements next year.