Acquisition of Juniper Networks by Hewlett Packard Enterprise (HPE) should make the new HPE Networking BU a unique, new network player that will have to make things difficult for Cisco in particular.

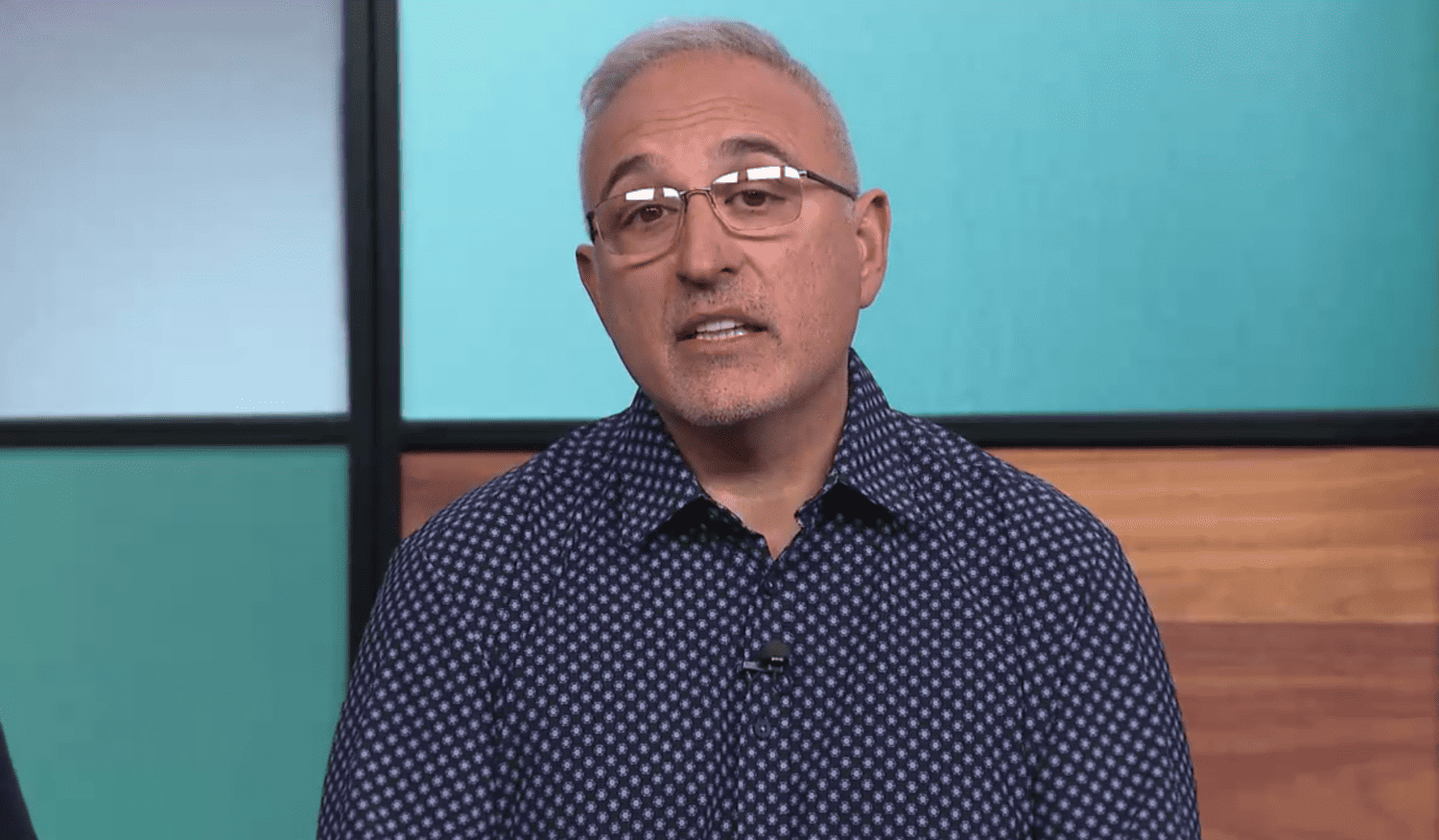

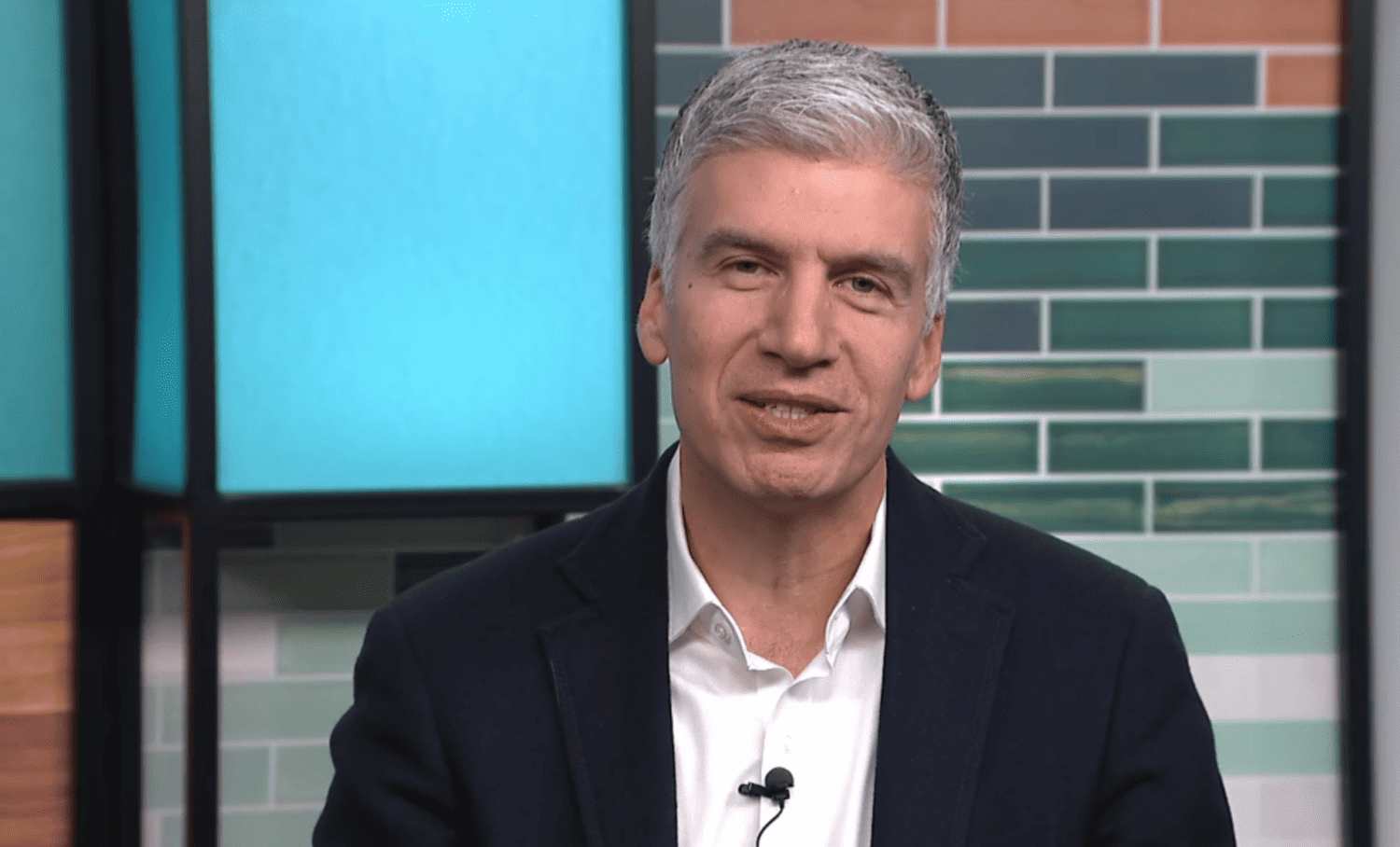

During a Q&A today, HPE CEO Antonio Neri and Juniper CEO Rami Rahim already gave a small hint of what the intent is behind the acquisition and subsequent integration of Juniper into HPE’s offerings. The general thrust of the message that the two CEOs delivered to the world was not entirely surprising that the two portfolios are highly complementary to each other. The merger of the components of both companies is going to ensure that the network takes a central role in everything HPE does. “The network becomes the core of what HPE does,” in Neri’s words.

Network fabric

During the session, Neri talks about creating a network fabric. He sees that as the end goal of integrating the network components of HPE and Juniper. This network fabric should then become the basis for the services HPE provides to customers. That should ensure that these services get to customers faster and in a better way. AI will also have a role in this story, of course. To get AI services to customers properly, it is important that the network over which this happens is optimized. That could improve with this integration, something for which there is certainly something to be said. As we also pointed out in our analysis yesterday, these players have different strengths (and therefore also weaknesses).

Creating a network fabric also serves as the basis for the full (AI-native) stack that HPE envisions. On top of the network fabric, HPE then places the Ezmeral data fabric. The contours of a full-stack architecture are already clearly visible.

HPE wants to become number one

With the future network fabric (the deal is not finalized until the end of this year at the earliest), HPE has an ultimate goal. They want to become the largest network vendor in the world. “We want to be No. 1 in everything we do,” Neri indicates. That means this acquisition is also a kind of warning to Cisco. That company is moving in a different direction, with a lot of emphasis on security, observability, as well as deep integration into a Networking Cloud.

The latter (Cisco’s Networking Cloud) is what the new HPE Networking (which Rahim will lead) is mainly up against. During the call, we got the impression that the Aruba name will eventually become less prominent. In any case, the business unit no longer seems to be using that name.

David against Goliath?

As for the chances of the new HPE Networking BU to knock Cisco off its throne, of course, at this point it is still a bit hard to predict. The joint offerings of HPE and Juniper are certainly very complete. Even in the area of ASIC design, among others, the two players are combining a lot of expertise and capabilities. Surely that should cause Cisco some concern.

On the other hand, Cisco has certainly not been idle in recent years and is gradually integrating various (in-house) components into its network offering, particularly Catalyst and Meraki. This could be compared to integrating Aruba and Mist’s products, although it might not be a true 1:1 comparison. With Silicon One, Cisco also has an offering in the ASIC design department. In terms of breadth of portfolio, Cisco measures up pretty well as far as we can see.

Getting Cisco will be no mean feat. After all, Cisco is really very big in the networking infrastructure field. To illustrate, about half of Cisco’s revenue of about $57 billion comes from what it calls Secure, Agile Networks. Aruba’s revenue at the latest figures was about $5.3 billion. Juniper does about $5.6 billion on top of that. That means that, combined, they are not yet at half the networking revenue that Cisco generates. Things could, of course, move quickly if they actually put out something fundamentally different and, more importantly, better. But it should be clear that HPE still has quite a bit of work to do. Nothing is impossible, but it will certainly be difficult.

HPE GreenLake

Strangely enough, the term GreenLake has not been mentioned very often in the news surrounding the acquisition. In fact, it has a positive impact there as well, according to Neri and Rahim. We would have been surprised if that hadn’t been the case. After all, GreenLake is the platform on which it should all happen. Just last year, Neri called it the North Star for HPE. It is the platform on which all innovation is focused, were his words then.

Rahim sees GreenLake as a great opportunity, as there is increasing demand for as-a-service. For HPE, adding Juniper’s offerings to services from HPE GreenLake means a big increase in ARR (Annual Recurring Revenue) for that platform. That is now $1.3 billion (total contract value is at $13 billion), but goes straight to the $2 billion mark with the addition of Juniper.

How much overlap is there?

Without question, it will be interesting to see how HPE goes about integrating Juniper Networks into its own portfolio. Neri and Rahim both stated several times during the Q&A that they are working toward a single offering. That means Juniper will not remain a stand-alone entity. That also makes sense, according to the two CEOs. After all, they see only complementary portfolios. Even Aruba and Mist they don’t see as overlapping. Those are aimed at different types of businesses and architectures, they claim.

The latter seems a bit odd at first. It’s hard to believe that Aruba never loses a deal to Mist and vice versa. Still, we understand what the CEOs mean. After all, Aruba is stronger on campus and edge, Juniper on core and data center. Then you have conversations with different companies and business units. Mist has traditionally been primarily focused on replacing Meraki. That is why Mist’s access points fit on a Meraki mount. At least that was true in the early days of Mist Systems.

Still, there is some overlap between the two, there must be. Neri gives the example during the Q&A that The Home Depot buys its entire network from HPE Aruba. Mist’s main reference is Walmart. Surely those are companies in the same category. Let’s just say there are plenty of distinctions to be made. That will also be why Cisco still carries the Catalyst and Meraki portfolios separately.

Other than that, Neri and Rahim’s claim does seem pretty accurate in terms of the two portfolios being complementary. For example, Juniper has traditionally been much more concerned with security, where at HPE that has long been on the back burner. That already changed somewhat last year, with the acquisition of Axis Security. Now HPE is getting a lot more security in one fell swoop. Not only with Juniper’s SRX firewalls, but also with its SASE and SSE offerings.

What will the new HPE Networking look like?

It will be quite a job to fully integrate these two worlds, that’s for sure. But what will remain of both portfolios after the integration is complete? There may be little overlap, but choices will have to be made. What happens to Junos OS, for example? That question Rahim answered somewhat evasively. The question of what will happen to the communities behind the companies was also not clearly answered. In itself, this doesn’t have te mean anything. No one really knows where everything is headed right now. However, if you want to integrate everything optimally, you cannot work with two completely different OSes.

This – and many other things – will undoubtedly be the subject of quite a few more discussions. In any case, the network fabric is coming, that much is certain. Exactly what it will all look like is still unclear. Should Cisco be worried at this point? That company is going to follow developments very closely, that much is certain. It undoubtedly has some innovations in store for itself in the coming years. It would be nice if we had another good networking battle. That keeps things interesting.

Also read: HPE Aruba is working on “Aruba Central Next Gen”: what is that?