Broadcom took a rigorous approach after acquiring VMware. It didn’t matter whether it was employees, customers, partners or products: everything got reorganized. VMware by Broadcom will be a much leaner optimized organization. Broadcom shows who’s in charge and which way the company wants to go. We sat down with SoftwareOne to discuss the future of VMware.

What exactly will be left of VMware is slowly becoming clear. However, no one knows if Broadcom has finished reorganizing and selling off business units. What is clear, however, is that Hock Tan, Broadcom’s CEO, has been able to put together an extensive plan and is executing it rapidly.

We sat down with SoftwareOne, a VMware partner with the highest status before and after the acquisition. How did they experience this acquisition, and how do they look to the future?

Broadcom is in charge and has a well-developed plan

At SoftwareOne, everyone agrees that the way Broadcom has executed their plan did not look good and came with many uncertainties. At the same time, Broadcom is now taking steps toward a new future. Steps that VMware would have taken anyway in some cases or that have been needed for many years.

Take, for example, stopping perpetual licensing and adopting a subscription-based model. That is now a trend in the industry, when Microsoft started with Office 365 you heard the same arguments, now you don’t hear anybody about it anymore. VMware would have also taken this step without an acquisition.

Other big changes are changes in the portfolio. The focus is on the data center and a portion of the cloud. End-user computing does not fit into that and has been sold to KKR. According to Hock Tan, a great product, but it doesn’t fit Broadcom’s vision. The same would be the case for Carbon Black, VMware’s security solution, but they could find a buyer that valued the solution.It now appears that Carbon Black will become part of Symantec and that layoffs are coming in that business unit.

Fewer VMware products, clearer portfolio

Within the data center portfolio, VMware will stop carrying hundreds of products and thousands of combinations. It now offers several bundles that customers can choose from. Two of these are the most important: VMware Cloud Foundation (it already existed) and VMware vSphere Foundation. Both products are a bundle of several VMware solutions that were previously offered separately. Besides those there are VMware vSphere Standard (VVS) and VMware vSphere Essentials Plus (VVEP).

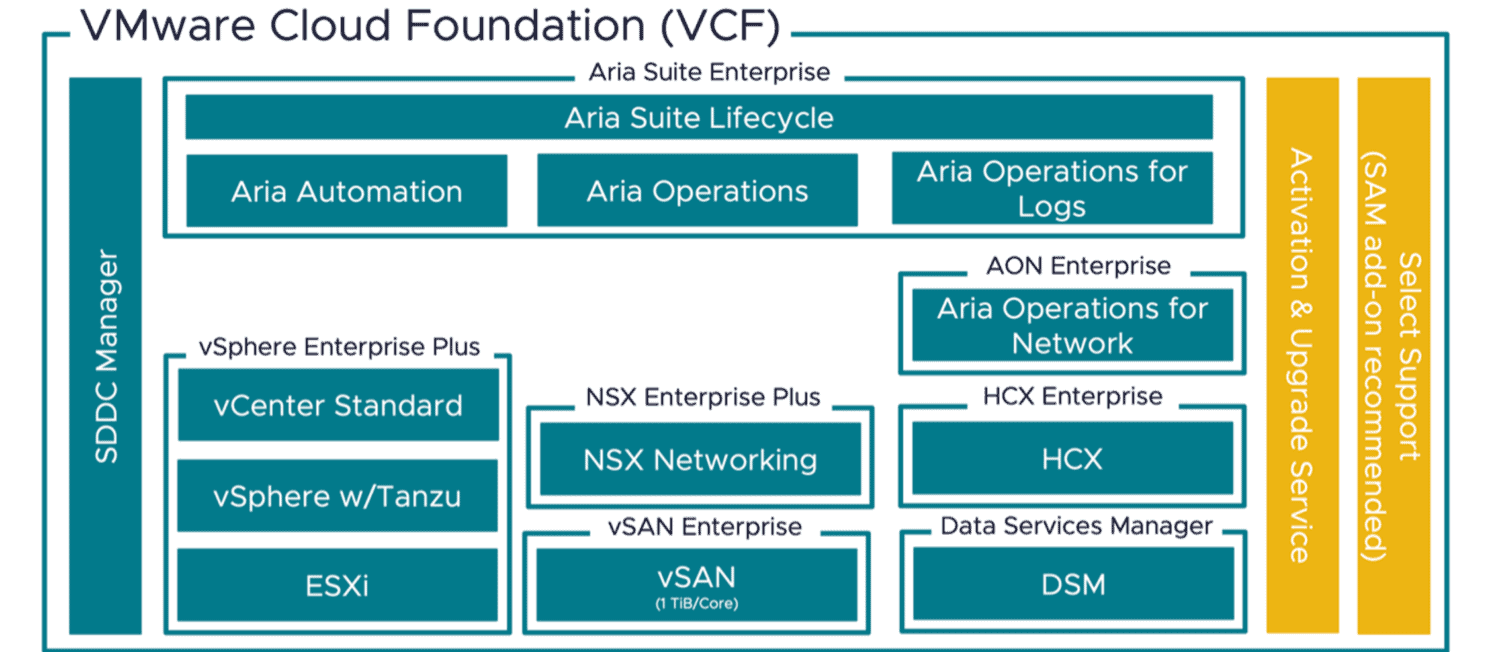

VMware Cloud Foundation (VCF).

VMware Cloud Foundation includes, for example, vCenter Standard, vSphere with Tanzu, vSAN, ESXi, NSX, and the Aria Suite with Aria Suite Lifecycle, Aria Automation and Aria Operations. See the image below for the complete overview.

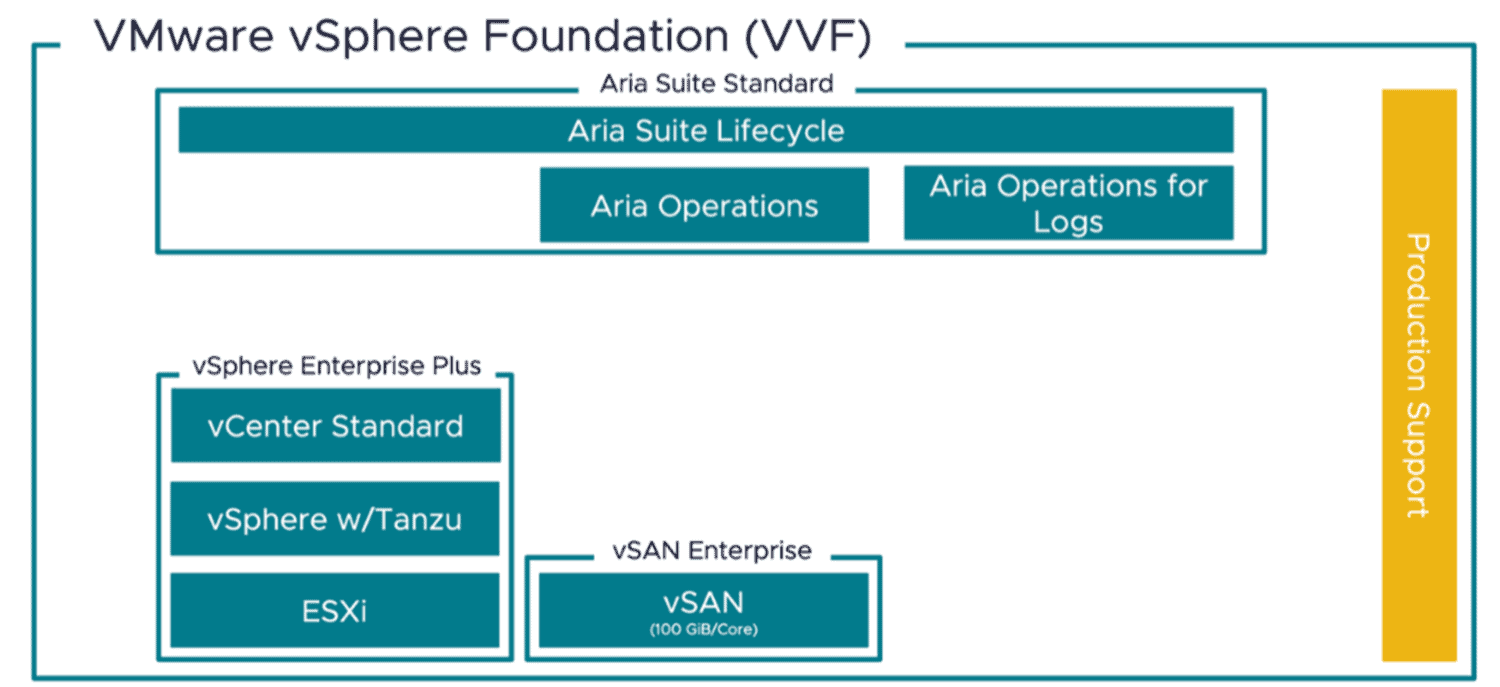

VMware vSphere Foundation (VVF).

Then there is Vmware vSphere Foundation, which contains vCenter Standard, vSphere with Tanzu, ESXi, vSAN and Aria Operations. This is a more compact bundle.

VMware vSphere Standard (VVS) and vSphere Essentials Plus (VVEP).

These are two stripped-down variants still being offered. Here, customers can choose either vCenter Standard or vCenter Essentials. The latter is a stripped-down version of Standard but a lot cheaper. However, it is limited to 96 cores and, according to SoftwareOne, is also only interesting if you get close to those 96 cores.

While these two bundles are very small, they are also limited. Customers are missing out on essential VMware solutions with these bundles. It is no longer possible to extend these bundles with additional VMware solutions, forcing customers to choose for VCF or VVF if the need more features. For example, do you want to run Kubernetes on vSphere? You need to upgrade to VCF. Want to use Aria? Even then, you’re bound to VCF or VVF.

The portfolio gets clearer and, therefore better

At SoftwareOne, they are not very sad that the portfolio has been renewed. Of course, they would have liked more flexibility, but not as it was. As they state at SoftwareOne; “new hires needed a minimum of six months to learn about VMware products, combinations and associated pricing.” VMware quotes in the past were often very complex and challenging to explain to a customer. That is changing now, and that is positive. However, how it will work out financially for each customer remains to be seen.

VMware licenses become more expensive in most cases but also offer more value

According to SoftwareOne, some customers will pay just a bit less with the new licensing model. Although most customers will pay more, and in some cases substantially more.

There are several reasons for this. For one, VMware has decided to stop offering basic support; there is now only production support, which is a bit more expensive. Also, it depends on the number of cores per CPU. The old perpetual licenses were per CPU up to 32 cores, whereas, in the new model, you have to pay per core. In addition, everything is now only available in bundles, so purchasing individual products is no longer possible. As a result, if you only have a few products but are now forced to choose VCF, the price tag can be a lot higher. For many customers, that is the reality and requires a good approach.

SoftwareOne will help customers use VMware better

That VMware is getting more expensive for many customers is a given. There is little SoftwareOne can do to change that unless customers can return to a VVS license, which is uncommon. Most customers now have to choose for VCF.

If your organization is forced to upgrade to VCF, the best strategy is to embrace and deploy VMware in the broadest form. That way, you can also partially recoup those higher costs. SoftwareOne wants to help customers get the most value out of VMware or, in this case, VCF.

For example, VCF includes Aria Automation, which saves organizations a lot of money. By helping a customer implement and roll out Aria Automation, a lot of IT management can be automated. This frees up IT staff for other tasks. To help customers do this properly, SoftwareOne has a partner capable of using VCF to its full potential.

Offering an alternative remains difficult

SoftwareOne does offer alternatives to VMware with, for example, Nutanix or Microsoft. However, since VMware is more or less the engine of your infrastructure, quickly replacing it with, for example, Nutanix is not so easy in practice. SoftwareOne has, therefore, chosen to help customers use VMware better and more efficiently.

At SoftwareOne, they are learning more daily about how the paths run at Broadcom and the new VMware. With the new strategy and rules, it’s a bit of a search at what points Broadcom is still flexible and where it draws the lines. By working with Broadcom daily, SoftwareOne learns and knows how it can better help customers with a good deal in some cases. For example, it will soon be possible to offer more discounts on 3-year agreements that also don’t have to be paid all at once, but annually. That sounds logical, but it was impossible with the old VMware. The customer had to pay directly for all three years.

Still, the benefits SoftwareOne now offers to ease the pain will not be enough for everyone. Some organizations would prefer a future without VMware. SoftwareOne knows Broadcom knows several customers will be looking at an alternative, and that’s okay. However, these would mostly be smaller customers. The larger customers will make up for that loss of revenue if they use VMware more and better. That is, at least, Broadcom’s vision.

Broadcom wants fewer partners

Something that has been widely written about in the media is how Broadcom deals with partners. The entire VMware partner program has been shaken up, and many partners have lost their status or left themselves because they don’t want to meet the high standards. The requirements for partner programs have become a lot tougher. However, Broadcom has re-invited almost all partners previously holding the highest status to enrol in the new program. In doing so, Broadcom will most likely have much stricter requirements for partners to obtain higher status. They finally went down from about 500,000 to 18,000 partners for a reason. They want to work with fewer partners.

Some media wrote that Broadcom would want to serve all the big customers, the strategic accounts, about a third of the customer portfolio, themselves. That does not appear to be entirely accurate. In fact, according to SoftwareOne, the large customers are the ones who prefer a partner. The partner knows VMware very well and knows the various options and costs involved when building an infrastructure. A vendor likes to sell the most expensive option with the highest margin. The partner chooses the best option for the customer and provides independent advice. Also, many government or semi-government customers work with tenders and approved vendors. Broadcom and VMware are not on that list, so for those customers, they need a partner themselves.

What does the future of VMware look like?

At SoftwareOne, they are cautiously optimistic by now. Things now seem to be stabilizing at VMware. Still, they must admit that Broadcom is not finished with reorganizing.

For example, we know that things will change soon at Carbon Black and that the end-user computing business has just been sold. Furthermore, it would not surprise anyone if Tanzu will be sold next year. In addition, many people have been laid off in the United States. A similar wave of layoffs in Europe is expected. However, it will take longer in Europe because employees here are better protected. There will be more clarity on this in the next few months.

VMware soon to be fully optimized for high-end customers

When Broadcom is done reorganizing and optimizing, it will have reduced VMware to a lean organization with a straightforward data center offering. SoftwareOne expects Broadcom also to try to serve the public cloud a bit better. For example, it will likely make it easier to move workloads from on-premises to the cloud without having to start changing licenses, which is just reflective of the current licensing offering where with the VCF bundle comes all the functionality.

Ultimately, Broadcom’s goal is to get a lot more revenue from those existing top 2,000 customers it wants to be involved with. If they succeed, it can miss the smaller customers, the 40 percent at the bottom, just fine. That will be a challenge, however, not only to execute but also in terms of image.

Next year should reveal which direction customers choose

Competitors use the turmoil associated with VMware’s acquisition and restructuring to bring in new business. Broadcom’s focus on the top 2000 customers will also benefit the competition.

The coming year should make clear whether organizations are willing to say goodbye to VMware or are more inclined to optimize VMware solutions as Broadcom and SoftwareOne have in mind.

Read our Liveblog on the Broadcom/VMware acquisition for a complete overview.