The Taiwanese chip company sees the expansion of European plants as the answer to rising chip material costs.

Currently, GlobalWafers has nine production sites. Three are in the United States, four in its home continent of Asia, and two in Europe. Both the U.S. and European plants will be expanded. For Europe, it means that locations in Italy and Denmark can expect expansion, CEO Doris Hsu tells Bloomberg.

“I believe that not only in the US but also some other countries, there will be some special tariff,” Hsu said about developments in the industry. She sees local manufacturing as a way out to avoid the higher tariffs. These expected higher costs stem from trade measures facing the semiconductor industry.

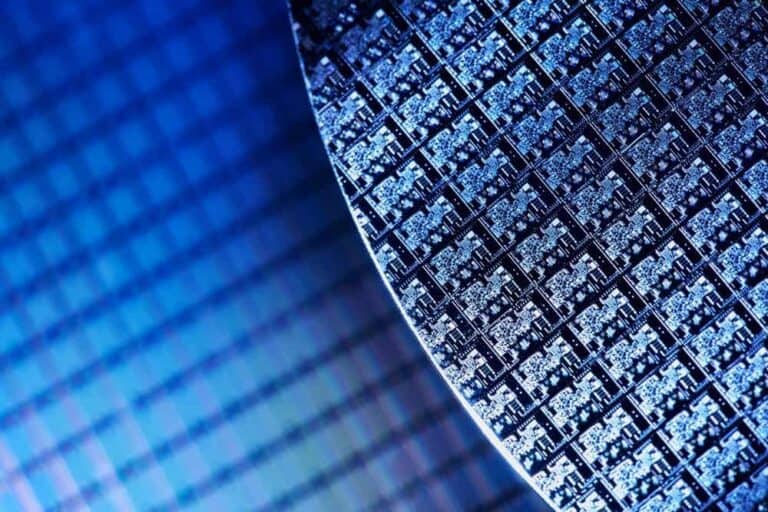

Several governments see semiconductor technology as a national security concern. GlobalWafers, in particular, has critical chip technology. Companies like Samsung and TSMC need wafer technology to make their chips.

Europe is implementing plans to attract more chip technology to itself. EU member states are also trying to entice chip companies through schemes. Earlier this year, for example, GlobalWafers received a grant of just over 100 million euros from the EU and Italian governments to build a manufacturing facility. In addition, the U.S. government made hundreds of millions available for expansion.

Strategy change

Previously, GlobalWafers still wanted to expand across the border through acquisitions. In 2022, for example, it still had the prospect of acquiring Germany’s Siltronic, but that ultimately fell through. The German government held up completion at the time. Hsu now confirms to Bloomberg that the strategy has since changed. Acquisitions abroad are proving difficult, which has made GlobalWafers focus more on expansion through foreign plants.

Tip: ‘German government stops GlobalWafers acquisition of Siltronic AG’