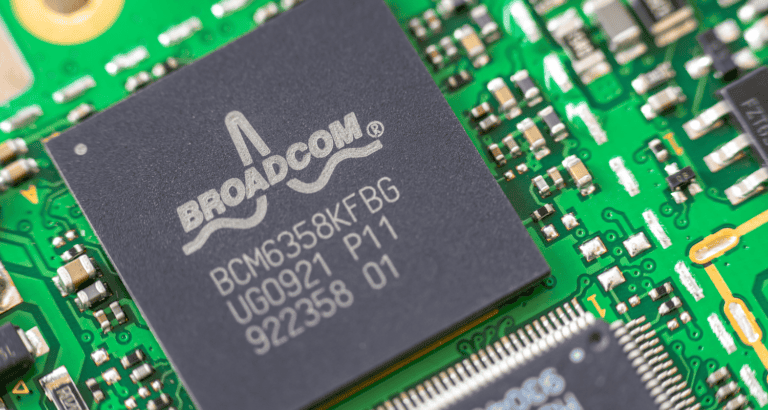

According to Broadcom CEO Hock Tan, big tech companies’ spending frenzy on AI will continue until the end of the decade. From Silicon Valley, Broadcom is receiving orders based on AI infrastructure investment plans that are being rushed over the next three to five years.

The CEO reveals this in a conversation with the Financial Times. Under his leadership, Broadcom recently reached a valuation of $1 trillion (€962 billion), with an optimistic outlook. Investments by large tech companies are running at full speed, and according to Tan, they will only stop when organizations run out of budget or shareholders intervene.

Broadcom’s financial results underscore Tan’s comments. This week, the chip company announced that revenue from AI grew 220 per cent in the past year to $12.2 billion. These impressive figures caused Broadcom shares to rise 24 per cent in a single day. Tan also predicts that sales from AI chips could reach tens of billions of dollars by 2027.

All roads lead to computer chips

Tan expects Broadcom customers to build clusters with up to 1 million AI chips by 2027. Hyperscalers are already showing great opportunities to generate revenue using generative AI. “They need to train [AI] on a scale that the world has hardly ever seen before,” the CEO said. “That consumes huge amounts of silicon. That’s where we show up.”

Recent advancements in generative AI are primarily due to combining more data and more computing power, leading to smarter algorithms. According to Tan, this formula will continue to work for now. “They have a formula to keep doing it and they are not at the end of the formula yet,” he states. “All roads lead to: you need more computing chips.”