A collaboration between two rapidly growing AI companies is worth $1.17 billion to VAST Data. CoreWeave will now be able to use VAST Data’s data platform and offer it to customers for their AI infrastructure.

The expansion of the partnership will enable VAST to work more closely with CoreWeave, according to Reuters, which was the first to report on the deal. There are also many other large customers, such as hyperscaler AWS and other so-called neoclouds such as Nebius and now CoreWeave. AI model builders such as Elon Musk’s xAI also use VAST.

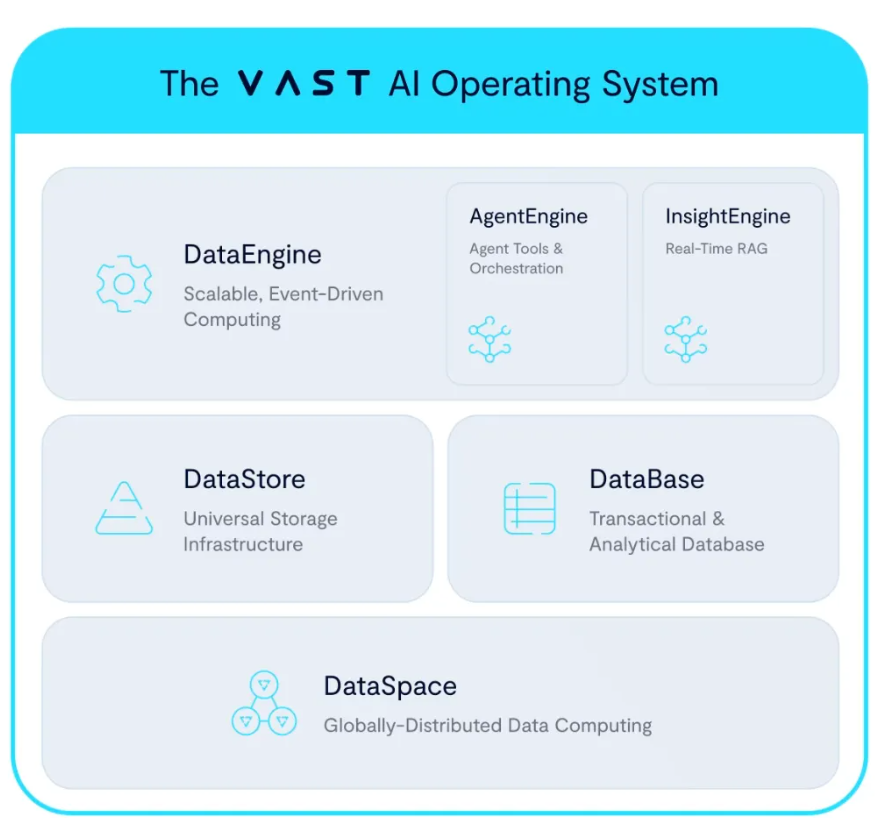

For New York-based VAST Data, the agreement provides a major financial injection. The company had previously stated that it had a positive cash flow and reported at the beginning of this year that it had posted annual revenues of $200 million. The company’s ambition is evident from its claim that it intends to become the “Operating System for the Thinking Machine.” In other words: an AI OS. As the diagram below shows, this consists of several components. At the foundation is the organization of data, while relevant current data is dynamically consulted via RAG on top of this.

CoreWeave chooses VAST as its primary data platform

The agreement between VAST Data and CoreWeave spans several years. Normally, such deals are for three to five years, according to Reuters. CoreWeave will use VAST as the primary data platform for its cloud infrastructure. This infrastructure gives customers access to GPUs for training and running AI models. Incidentally, the range of neoclouds is relatively basic beyond that GPU access. Collaborations such as the one with VAST Data can create added value that has been largely lacking until now.

VAST Data builds software that helps companies store and process data of all shapes and sizes, including unstructured data. Customers pay based on the capacity and features they use; today, the use of a data platform is attractive for AI applications. VAST and CoreWeave reportedly want to align their product roadmaps to improve data storage and access for AI workloads.

Fundraising and IPO plans

The deal could also help VAST in its fundraising efforts. Reuters reported in August that VAST was in talks to raise several billion dollars in new capital. This would be at a valuation of up to $30 billion. Potential investors include CapitalG, Alphabet’s growth fund, and leading AI chip maker Nvidia.

If it succeeds in securing an investment round like this, it would more than triple the value of VAST. VAST’s latest valuation was $9.1 billion, but this was based on a financing round in 2023. Investors see the company as a potential IPO candidate. The same applied to CoreWeave, which did end up going public back on the 28th of March.