Nvidia’s quarterly figures were once again impressive. Although the AI giant’s earnings overshadows the results of other IT players, Techzine provides its usual overview of the relevant figures. This time, we also take a look at Lenovo and Palo Alto Networks.

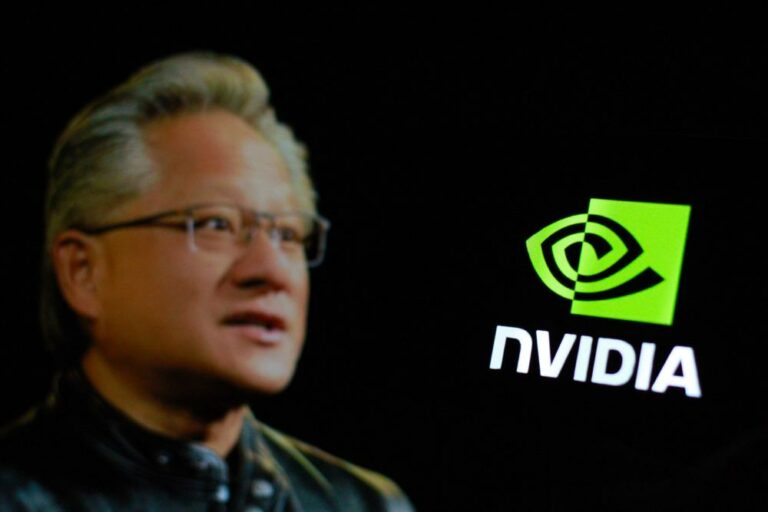

For Nvidia CEO Jensen Huang, the stellar results themselves do not do justice to the actual sales of Blackwell, Nvidia’s latest architecture in production for GPUs. These figures are “off the charts.” Total revenue beat the predicted $54.92 billion by a hefty $57.01 billion. The expected revenue for the next three months also exceeds analysts’ expectations: $65 billion versus $61.66 billion.

This meant that Nvidia shares were once again in demand. A 4 percent growth on a market capitalization of $4.53 trillion is $181.2 billion, so that figure in dollars has been virtually added to Nvidia’s value. In a broader sense, Nvidia’s figures are, as before, calming the waters on the stock market. Time and again, it seems that the appetite for AI chips is insatiable, particularly among hyperscalers Microsoft, Google, Amazon, and Oracle, and affiliated AI companies that predominantly purchase their capacity from these players, such as OpenAI, Meta, and Anthropic.

Lenovo: almost successful in the ‘old’ world

Since Lenovo’s acquisition of IBM’s x86 server business, the question has always been: when will it become profitable? That was once expected to be sometime in 2022, as The Register notes. However, since then, the figures for Lenovo’s x86 server racks have regularly been in the red. Lenovo’s Infrastructure Solutions Group (ISG), as the former IBM division is known, posted $20.5 billion in revenue. That was 15 percent more than the same quarter in 2024. Profits were meager but present, with $380 million in the green. Consistent, solid growth should follow quickly, Lenovo concludes. Liquid cooling-based systems, mostly AI servers, are on the rise. This segment grew by 154 percentage points this quarter.

The x86 server market is what you might call the “old” world in an era of AI expansion, but these systems dominate in actual use among regular organizations. The introduction of AI has yet to follow there. Nevertheless, AI also plays a role in the PC world and in smartphones, albeit in a much less impressive form than in AI servers. In this area, Lenovo’s Intelligent Device Group (IDG) posted revenue of $15.1 billion, up 12 percent from the same quarter a year ago. Lenovo accounts for 31.1 percent of all “AI-based” Windows systems, while the Chinese company supplies 25.6 percent of the total PC market with systems.

Palo Alto: strong figures, billion-dollar acquisition

Although Palo Alto Networks’ shares fell 2 percent after the market closed, the company did well. It posted revenue growth of 16 percent to $2.47 billion. Analysts had expected $2.46 billion. However, the expected revenue for the coming quarter was slightly lower than analysts’ predictions, at $2.57 billion compared to $2.59 billion.

In the long term, a new proposed acquisition was perhaps bigger news. Kubernetes observability company Chronosphere will be purchased for $3.35 billion, if approved. Palo Alto’s acquisition spree continues: in April, it bought Protect AI for half a billion dollars, followed by a $25 billion deal to buy CyberArk.

Chronosphere expands Palo Alto’s capabilities to provide observability for cloud-native platforms. In addition to direct security measures, IT administrators can also use this tooling to monitor the performance of applications and infrastructure, for example, to keep costs under control. The acquisition price of $3.35 billion is significantly higher than the investments Chronosphere has raised, totaling $369 million spread over four rounds.