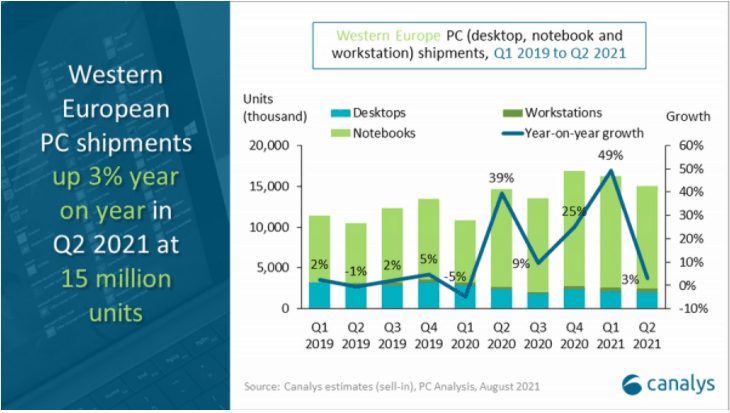

The changes that happened in work and technology following COVID-restrictions provide an interesting case study. The latest report by Canalys, Western EU exhibits slowing growth in sales of PCs (workstations, notebooks, and desktops) even though the demand is high.

That growth, which stands at 3%, is compared to the initial jump in PC sales seen after the initial COVID restrictions came into effect. The second quarter of 2020 recorded a 39% increase, compared to the same quarter in 2019.

According to analysts, the meagre 3% growth year on year in the second quarter of 2021 could have been higher, if not for the global component shortage.

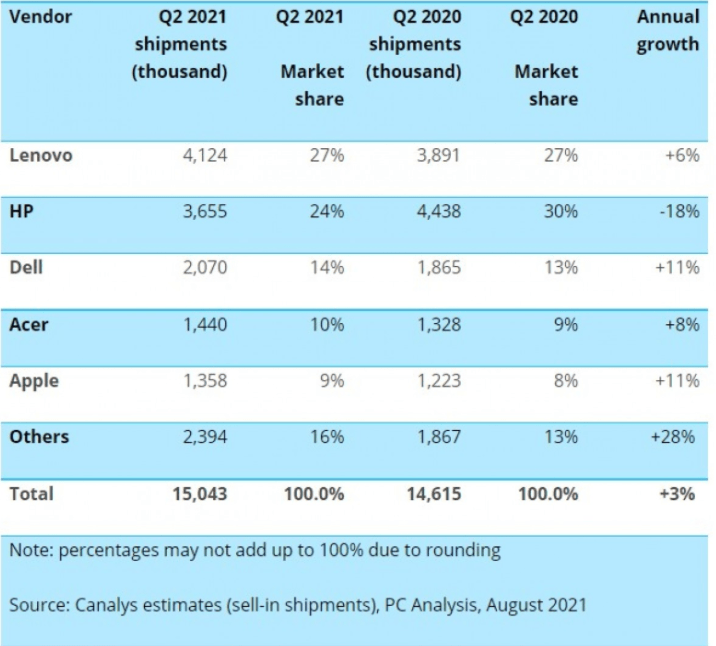

Lenovo is the PC king of the Western EU

In Western Europe, PC sales for the second quarter of 2021 hit fifteen million units, most of which were made by Lenovo, grabbing 27% market share with 4.1 million units shipped. HP rode Lenovo’s coattails in second place with a 24% market share and 3.7 million units shipped. Dell (14%), Acer (10%) and Apple (9%) follow.

Canalys noted that Lenovo has been leading Western Europe sales for the past three consecutive quarters, thanks to its position as a global leader, which offers it more bargaining power with suppliers to fill orders faster than the competition.

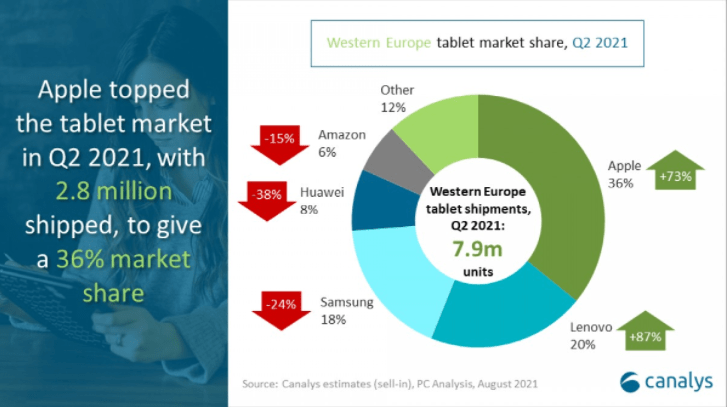

Tablets rose

HP, which lost its position as market leader to Lenovo, could not balance its US and EU operations well enough, which is why it floundered. Tablets are a cheaper alternative to PCs for remote working and learning and are most popular among students with no intensive technical requirements.

Overall, tablets shipments rose by 18%, to hit 7.9 million units shipped. Both Lenovo (20%) and Apple (36%) seem to be doing well on the tablet front, as Samsung, Huawei, and Amazon taking positions three, four and five respectively and seeing a decline in tablet shipments.