In mid-2024, HPE shared that it had a KVM-based virtualization solution in development. It looked like it would offer an alternative to small and medium-sized VMware vSphere environments at that time. Today, the product is officially available, and it is clear that HPE has built an enterprise-grade alternative to vSphere that is scalable to tens of thousands of virtual machines. In addition, the company has made it clear to us that it has sufficient ambitions and plans for continued product development.

HPE VM Essentials Software stems from customer demand, HPE said. Following Broadcom’s acquisition of VMware, many organizations began looking for a VMware alternative. HPE began developing HPE VM Essentials Software in November 2023. The ambition was to make the Ubuntu KVM solution enterprise-ready and thus help customers get a (simple) alternative. That ambition has since passed. Instead, it now offers a complete vSphere alternative.

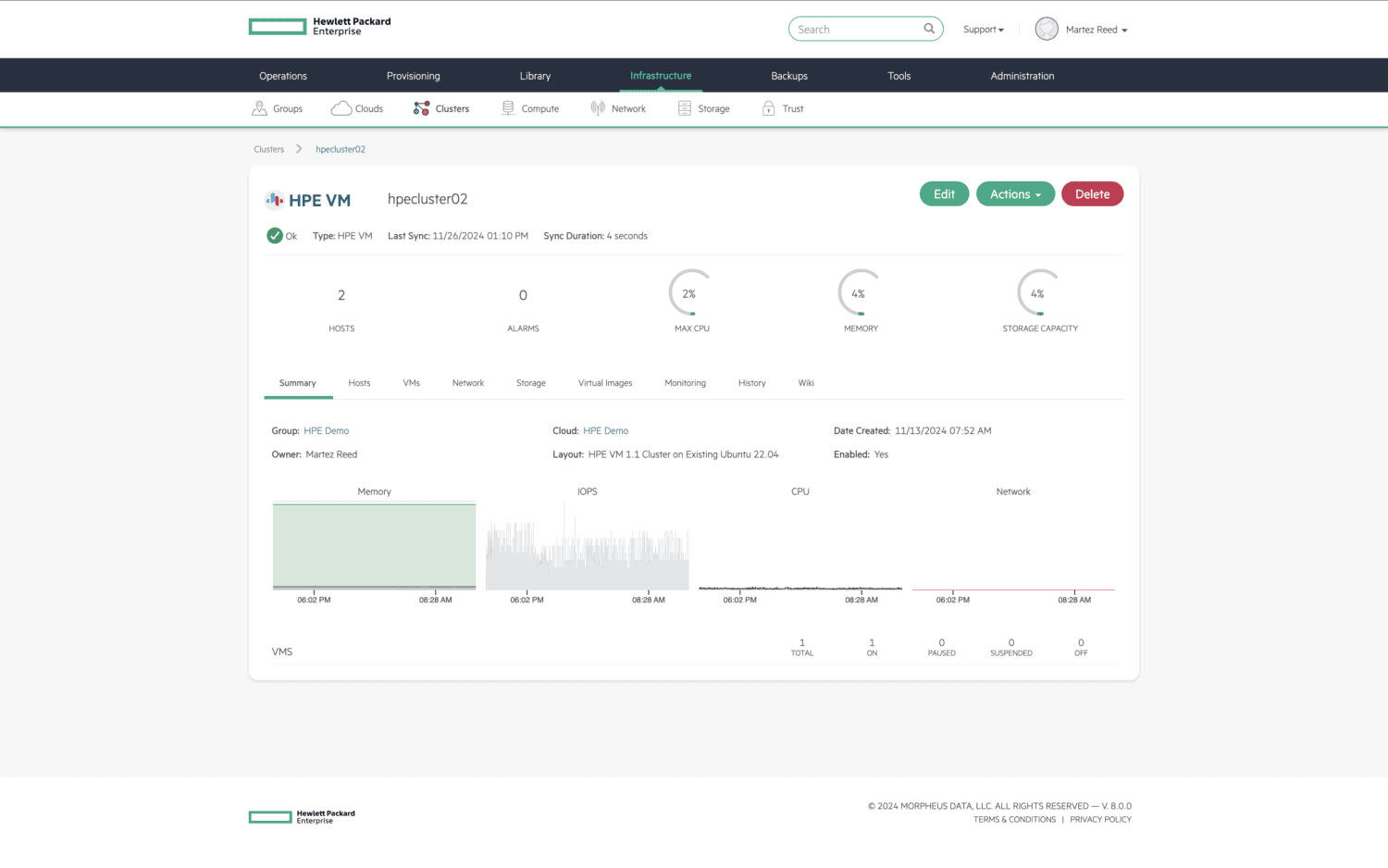

This summer, development suddenly gained momentum when HPE announced the acquisition of Morpheus Data. HPE had been working with Morpheus Data for two years and was already selling this solution to its customers. With Morpheus Data, you can manage vm’s on different hypervisors and clouds. You can create and edit VMs in different environments and migrate between public and private clouds. Morpheus Data also features an automation layer and a self-service portal. With this self-service portal, organizations can give different business and IT teams access to a virtualization platform. Morpheus Data’s software is also multi-tenant and suitable for MSPs. Morpheus Data’s technology now underlies HPE VM Essentials Software.

HPE VM Essentials Software is based on Morpheus Data

For this article, we spoke with Hang Tan, Chief Operating Officer Hybrid Cloud at HPE. He gave us an insight into how HPE VM Essentials Software came about. With Morpheus Data, HPE acquired the technology to create, manage and migrate VMs easily. Based on Morpheus Data’s software stack, HPE has now developed a virtualization platform that allows you to create, manage and migrate both HPE VM Essentials Software VMs and VMware vSphere VMs.

HPE VM Essentials Software is designed as a portal that simplifies VM management and requires little explanation. Perhaps most importantly, HPE has purchased proven and scalable technology with it. The software is already proven and can also manage hundreds, thousands, or even tens of thousands of VMs, Tan said.

So, this is no longer an enterprise-grade KVM alternative to VMware but a full-fledged virtualization alternative to vSphere, which can also be quickly adopted and even has vSphere support. You will soon be able to manage both your VMware VMs and HPE VMs from the HPE VM Essentials Software portal or simply migrate quad machines from one platform to another.

Currently, HPE VME only uses a small portion of Morpheus Data’s software stack. HPE will spend the next few months determining what other technology they will integrate or what might go toward the HPE Private Cloud solutions. The company can quickly take its virtualization platform to the next level with Morpheus Data technology.

For now, HPE VME and Morpheus Data will continue to co-exist. Customers can purchase the products separately.

VMware vSphere customers can transition easily

The HPE VME solution is currently a good alternative to VMware for virtualization. The VMware customers who take the biggest hit from Broadcom’s price increases are those who only purchase VMware vSphere. Broadcom has limited options, forcing these customers to switch to the VMware Cloud Foundation (VCF). This suite consists of a series of former VMware solutions, not just vSphere. As a result, licensing costs are also many times higher, reportedly up to 10 to 12 times. For those customers, the new HPE VME solution comes in handy. HPE VME can be purchased through licenses. HPE works with a per-socket price.

To deploy HPE VME, you can use an HPE GreenLake Private Cloud solution, but you don’t have to. HPE VME is now also available separately and can be deployed on third-party hardware, such as Lenovo or Supermicro. So, organizations that already have an extensive server farm can simply replace the virtualization software.

HPE is releasing an update to its Private Cloud offering this spring. With it, existing customers running VMware on HPE Private Cloud can easily migrate to HPE VME on HPE Private Cloud.

The potential of the HPE VME platform for years to come

HPE now has a proven and scalable alternative to VMware vSphere. It is also easy to transition and migrate, which is not going to hurt HPE. Many organizations are urgently seeking an alternative to their VMware portfolio. HPE is making a big deal out of this, especially since it also offers enterprise service legal agreements (SLA) for HPE VME.

VMware customers who also use vSAN, for example, also have little to fear. HPE has a solid portfolio of comprehensive storage solutions. In terms of data management, backup management and instant recovery, there is no need to worry either. Commvault and Cohesity have signed on as HPE VME partners and can already backup virtual machines. Zerto, part of HPE, provides support for instant recovery.

Tan did not want to speculate too much about future developments. He did acknowledge, however, that HPE has a tremendous amount of in-house technology that they could theoretically use to make HPE VME much better. HPE may choose to compete much more broadly with VMware.

VMware NSX vs HPE Aruba and Juniper

VMware has recently tried adding a solid security layer to its portfolio. It didn’t succeed with Carbon Black; only customers who got it virtually for free implemented it, but most customers integrated a security solution of their choice. The same will happen with HPE VME.

What does speak for VMware is NSX. That’s a solid security layer at the network level. HPE can’t offer much in return right now, but we think that’s just a matter of time. HPE acquired Aruba years ago and has a solid campus and data center portfolio with many software-defined networking solutions. Something like network segmentation could well be integrated over time.

Finally, the acquisition of Juniper is also planned. However, that acquisition has been somewhat delayed due to objections from the United States. We do expect that acquisition to go through. HPE will then have even more network technology at its disposal, as well as the knowledge to expand software-defined networking within HPE VME.

Automation

Automation within the VMware portfolio has increased significantly in recent years. Automation is increasingly important within organizations. IT departments want to do less management manually if they can also automate it.

With the acquisition of Morpheus Data, HPE also has the technology to apply automation to VMs. Now, they can transfer or repackage that 1-to-1. We assume HPE is going to take a good look at how it can integrate this into its overall GreenLake portfolio so that, in addition to VMs, it might work for other things as well.

Tan suggested that the future is not yet clear. The acquisition was completed not long ago. Currently, HPE VME and Morpheus Data are offered as two separate solutions.

Kubernetes

What we know for sure is that, probably later this year, HPE will integrate its current Kubernetes offering with HPE VME so that containers and VMs can be managed within the same control plane. This is also a natural development. Many other solutions also bring virtualization and Kubernetes together.

Has HPE suddenly struck gold?

In mid-2024, we didn’t expect HPE to be able to make this available today. Within a year, the company has rigged up a full-fledged virtualization platform that at least rivals a standard vSphere solution and is scalable to thousands of VMs. Customers can purchase HPE VM Essentials Software today through all known HPE partners.

The next few months will be exciting for HPE when it should become clear how quickly this solution will be adopted. How many customers will subscribe to and roll out HPE VME? That may secretly be quite a few more than HPE expects. No doubt we will know more in six months. Hopefully, they will be able to tell us more specifically what they will be investing in regarding features for HPE VME.

If we are to judge, HPE may have struck gold, but silver is guaranteed. For Nutanix, it is bad news. That company was waiting for VMware customers to come their way. Now, there is more choice, and Nutanix has to compete with HPE. Finally, Broadcom could come to its senses and lower prices. However, we consider the chances of that happening to be enormously small. Broadcom has been very clear from the beginning that they are focusing on the really big customers. VMware’s parent company is fine with the remaining customers switching to something else.