Apple yesterday updated its quarterly sales forecast. The company states that so far fewer iPhones have been sold than expected. At the same time, it also states that it is difficult to produce sufficient copies of certain products. This ensures that the turnover is lower than previously predicted.

That’s what Apples CEO Tim Cook says in a letter to investors. There are many reasons for the disappointing figures so far. For this reason, the company decided to issue a turnover warning. Now it is expected that the turnover will be 84 billion dollars, whereas previously it was expected that the turnover would be between 89 and 93 billion dollars. The margin remains the same: around 38 percent.

Many setbacks

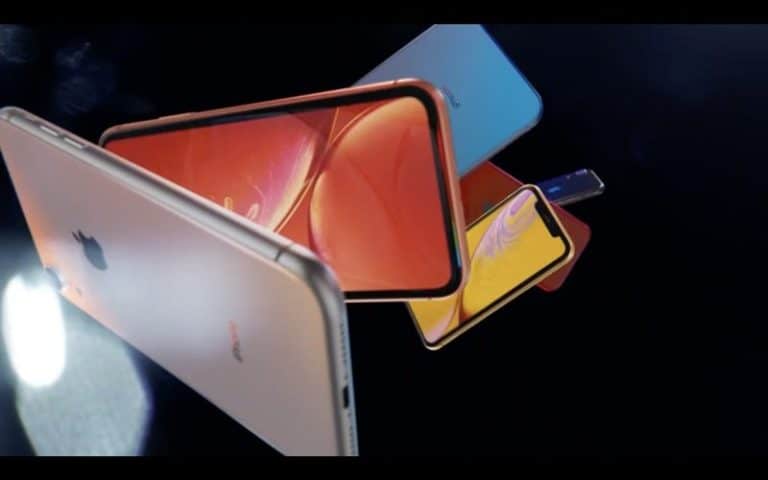

In the letter Tim Cook writes about several reasons behind the disappointing turnover. First of all, the disappointing sales of new iPhones. People wouldn’t want to buy the new appliances as quickly, partly because they are so expensive. Outside the United States, the dollar exchange rate makes them relatively expensive, which, combined with the new trend for consumers to buy non-subscribed smartphones, means that consumers are less likely to buy new and expensive devices.

The fact that people could replace the battery of their old iPhone relatively cheaply last year doesn’t help either. Combined with the weaker economic growth in China, Tim Cook says that this has resulted in fewer handsets going over the counter than expected. But it’s not just iPhones: according to Cook, Apple also struggled to keep up with demand for some products.

MacBook Air, iPad Pro, AirPods and more are popular. Because Apple released so many different new products last year, it was sometimes hard to keep up with the high demand. According to Tim Cook, this was already in line with expectations.

Positive note

Tim Cook also stresses in the letter that the expectations for the future remain positive. We manage Apple for the long term, and Apple has always used times of setbacks to rethink our approach, take advantage of our flexible corporate culture, adaptability and creativity, and always stand up for better results.

Despite this positive note with which Cook ends, the shares immediately afterwards fell in value by eight percent. Currently, shareholders trade them for $157.93 per share. This makes Apple worth $749 billion at the time of writing.

This news article was automatically translated from Dutch to give Techzine.eu a head start. All news articles after September 1, 2019 are written in native English and NOT translated. All our background stories are written in native English as well. For more information read our launch article.