The train toward the pot of gold for which Nvidia currently has a first-class ticket has not yet reached its terminus. The company posted revenue of 30 billion dollars (27 billion euros) last quarter. That is more than twice as much as the same period last year and better than the previous quarter. Profits also rose. However, the company’s stock market value nevertheless fell, mostly due to investors’ overblown expectations.

Not surprisingly, most of the revenue (26 billion dollars) came from the division that supplies GPUs for AI workloads. As long as this hype continues, the company will do well here. However, analysts told Reuters that growth is expected to slow down and even decline next year.

Nvidia garnered a profit of 16.6 billion dollars or nearly 15 billion euros. This result is also better than last year’s quarter by more than one and a half times. Compared to the previous quarter, profits were also up about 12 percent. Next quarter, Nvidia expects to increase sales again. It is betting on 32.5 billion dollars of revenue, with a few hundred million dollars margin up or down.

Nvidia is planning to buy back 50 billion dollars worth of its own shares, about 420 million shares, or 2 percent of the total. That would not be the first time. A buy-back worth 25 billion dollars already took place last year, and one for 15.4 billion dollars earlier this year. Such actions communicate confidence and usually boost stock market value, which is good news for shareholders.

‘Blackwell on track’

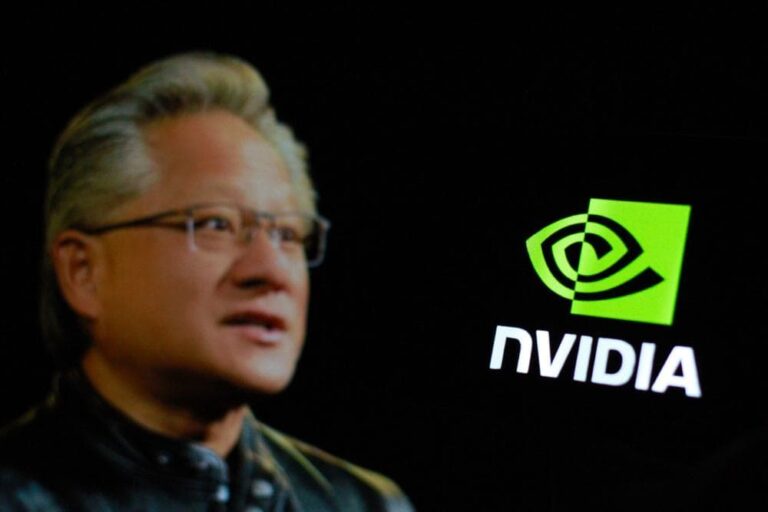

Lately, there has been some murmuring about the company’s latest Blackwell GPU. The Blackwell B200 GPU was said to be at least three months behind schedule after an ‘unusually late’ discovery of a flaw during the manufacturing process. In a call with investors, Nvidia CEO Jensen Huang downplayed this matter and reported that the chips will be ready by the end of 2024, as planned. Earlier, there were fears that the launch of the new server chips would have to be postponed to 2025.

That appears not to be the case. Moreover, Huang stated, the eagerness of customers to get their hands on the current Grace Hopper chips makes up for this delay. The first samples of the Blackwell chip are also said to be already on their way to partners and customers.

Impact on the entire chain

In any case, investor expectations were so high that the results could only disappoint, leading to a 6 percent drop in the share price aftermarket. Talking about the amounts Nvidia can now boast of would mean a loss of stock market value in the tens or even hundreds of billions of dollars. This also affects the rest of the supply chain, as hyperscalers such as Microsoft, Google and AWS, which run Nvidia chips in their data centers, also saw their stock price drop slightly.

Because of impending market saturation, such sky-high expectations are no longer realistic. Incidentally, Nvidia CEO Jensen Huang himself recently stoked the hype fire by stating that because of the AI boom, customers only wanted ‘more, more, more’.

Also read: Tech stock market slumps: AI hype disappoints investors