Denmark’s Banking Circle recently acquired Biller, a young Dutch fintech company. The startup offers a platform that allows businesses to make purchases based on invoices.

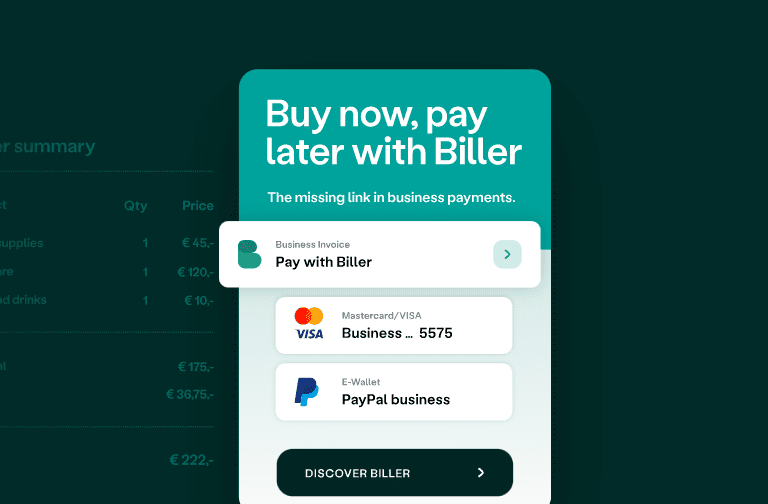

Biller was founded six months ago. The acquisition provides Banking Circle with a fintech platform for so-called buy-now-pay-later (BNPL) purchases. Biller’s platform allows companies to order goods and servers based on invoices. The platform performs real-time credit checks, fraud checks and automated accounts receivable management. As a result, buyers make quick and safe purchases while sellers save on operational expenses and risk management.

Access to ecosystem and growth capital

Biller hopes to benefit from the acquisition. The fintech startup gains access to the entire Banking Circle ecosystem. In addition, the incorporation provides the startup with an immediate banking license, allowing the company to achieve greater European coverage. Furthermore, Banking Circle intends to pump working and growth capital into the startup to achieve future growth ambitions.

Banking Circle, a financial infrastructure provider, hopes to use the acquisition to strengthen its BNPL expertise. Banking Circle works with approximately 200 financial institutions. Its technology is used by payment platform Stripe and Alibaba Group, among others.

By moving into the BNPL market, the Danish company competes with well-known BNPL providers such as Klarna and Afterpay. These services have grown strongly in the past two years, partly due to the pandemic.