ZeroFox, a cybersecurity firm, is set to go public via a special-purpose acquisition company merger with L&F Acquisition Corp. The merger is not the only thing ZeroFox announced on Monday since it also said it is acquiring Theft Guard Solutions (also known as IDX).

The SPAC merger puts ZeroFox’s value at $1.4 billion. The combined company will be named ZeroFox Holdings and display the ticker symbol “ZFOX” when the deal is complete.

The merger includes Monarch Alternative Capital and other firms pouring about $170 million into ZeroFox. ZeroFox Chief Executive, James Forster, said in a statement the company has helped companies address emerging security problems since its founding in 2013.

Changing times

Forster added that the rapid digital transformation the world has undergone in the past few years has opened up new avenues for attackers, translating into unprecedented increases in the breach rate. Forster says that ZeroFox believes in making external cybersecurity a top-three priority.

He also said that external cybersecurity should be part of the critical security tech stack for chief information security officers, citing the inherent risk in relying on perimeter firewalls and internal endpoints alone in asset and customer protection.

A changing company

The company last had a funding round to raise venture capital in February 2020, netting $74 million. The platform created by the company is used to find threats and analyze content on many channels, including GitHub, social media, mobile app stores, and Slack.

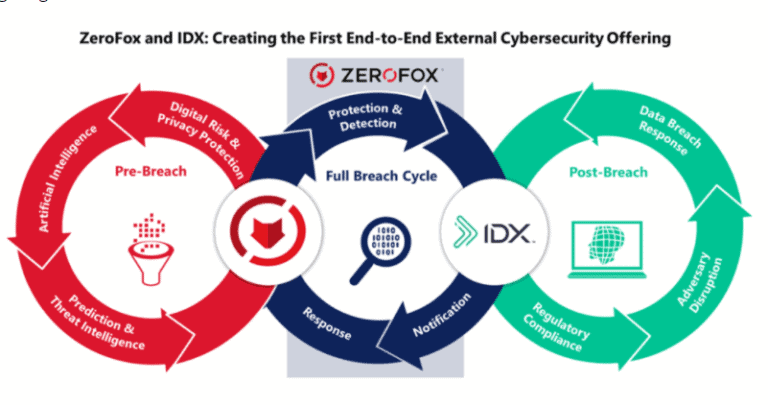

The system works by leveraging artificial intelligence to sift through data and isolate items of security interest.

The last time ZeroFox was in the news was July when it acquired dark web intelligence research company Vigilante ATI Inc. for an undisclosed price. IDX was founded in 2003. It offers customers a consumer privacy platform to control their identity and privacy.