Salesforce is engaged in a hefty battle at the board level with several activist shareholders. These believe that Salesforce is performing far below its potential and that things must improve. Revenue and especially profit needs to go up. One of the demands of Elliot Management, the largest activist shareholder, was to appoint its own people to Salesforce’s board of directors; that demand is now off the table. A win for Salesforce, but the question is at what cost?

Salesforce has been under pressure for some time, several activist shareholders have taken stakes in the company and are demanding better results. Last year Salesforce shares were under a lot of pressure, at the lowest point a Salesforce share was worth almost 50 percent less than the year before.

In previous years, Salesforce made three significant acquisitions involving billions of dollars. First it acquired MuleSoft for $6.5 billion, followed by Tableau for $15.7 billion and finally Slack for $27.7 billion. With that, the organization grew substantially, from 50,000 to about 80,000 people, but results lagged. This put pressure on the stock, and these activist shareholders saw their opportunity to step in.

What do activist shareholders want?

An activist shareholder is only concerned with one thing and that is more profit. More profit means more dividends can be paid and the shareholder gets a positive return on their investment. Often these types of shareholders step in when things are not going so well and then demand significant changes in the short term to improve margins. As soon as the results increase, these shareholders exit quickly to cash in their profits.

Several steps can be taken to improve results quickly. The first has already been taken by Salesforce by announcing a major round of layoffs that will see 7,000 people lose their jobs (10% of the workforce).

Appointment to board to gain more influence

Shareholders currently have only shares but no direct influence in the boardroom. However, if they own enough shares, they can nominate people to the board of directors. If an activist shareholder has their own people in the boardroom, they will have more control and influence on business processes. Elliott Management was pushing for this, but has now withdrawn those nominations. Which in itself is an odd move because why give up that influence? On the other hand, keeping activist shareholders out of the boardroom is highly desirable for Salesforce. The people at Elliott will not do that for free, the question now is; what did Marc Benioff, Salesforce’s CEO, promise them?

More layoffs

The answer seems to lie in a Bloomberg article from last Friday. Salesforce’s COO, Brian Millham, revealed that: “If we feel the structure of the organization needs to change, we will do so to drive efficiency.” In the corporate world “drive efficiency” means cutting jobs. With that, there is a huge possibility that there will be a second wave of layoffs in the near future. This has already happened at Amazon and Meta. The question is how many people and in which regions.

Divesting business units

Another step could be to divest business units. For example, business units created after past acquisitions could be divested again. This could generate the necessary billions to pay more dividends. This does not seem to be the case at Salesforce for the time being. We recently attended TrailblazerDX, Salesforce’s developers conference. Salesforce’s vision is still to further integrate solutions like MuleSoft, Slack and Tableau with each other and with Salesforce solutions. Divesting one of those solutions would kill Salesforce’s entire strategy. The only product Salesforce could possibly divest is Quip, which is a kind of Office suite that Salesforce bought in 2016 for $750 million. Its adoption is low, and integration is limited. The question is how much money could be made out of that sale. Probably less than a billion dollars.

Salesforce sticks to vision

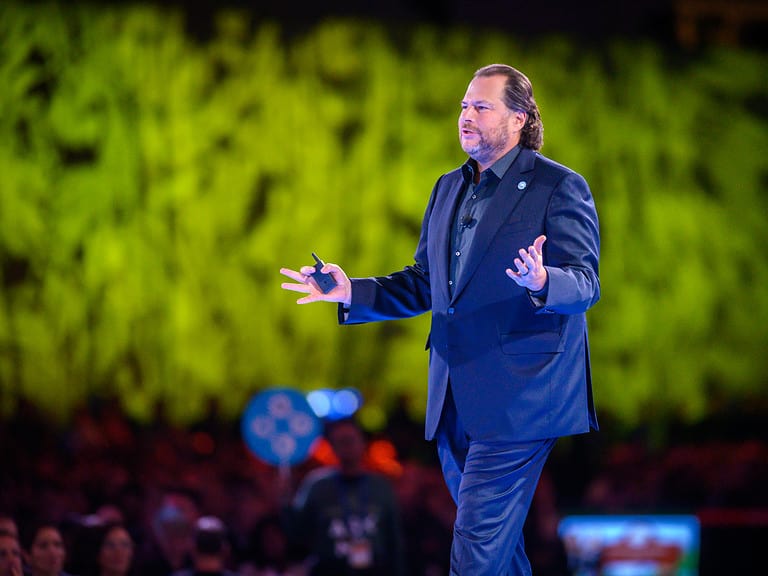

At TrailblazerDX a few weeks ago, Marc Benioff was the big absentee. He did share photos on social media of the event build-up, but on the event days, he was nowhere to be seen. In our opinion, that was a conscious decision to make the developers’ conference really about the products and not about the layoffs, company results and activist shareholders.

Still, there were small moments during keynotes in which Sarah Franklin, Chief Marketing Officer, lashed out at these activist shareholders. For example, she stated very clearly that whatever happens, Salesforce will stick to the 1-1-1 principle. Something that no doubt came up in discussions with these activist shareholders. To increase margins, getting rid of the 1-1-1 principle would quickly produce results. Salesforce’s 1-1-1 principle means that employees can use 1% of their working time (paid) for volunteer work, 1% of the products Salesforce provides go to charities, and 1% of the total revenue is used for charity.

Acceleration in integration

Furthermore, we got the sense that Salesforce is gaining some momentum in integrating its various solutions. They have, of course, made all these acquisitions and most of them still work as standalone solutions, but they are also integrating with each other in different areas. During TrailblazerDX, we sensed that something of urgency has come to accelerate the integration process.

Salesforce results have improved significantly

Finally, Salesforce finished last quarter with tremendously good numbers. Revenue rose to $8.38 billion, 14 percent more than the previous year. Furthermore, Salesforce will buy back $20 billion in shares, again reducing shareholders influence somewhat. Salesforce shares have also risen sharply since then. The effect of the first round of layoffs is not yet visible in the numbers, but that will start to yield even better margins. The same goes for a possible second round of layoffs.

Salesforce remains on track and seems to be fighting off activist shareholders

Overall, Salesforce seems to have acted reasonably quickly, keeping the company and the board in control. In other companies, we have seen activist shareholders seize power in the boardroom and founders, CEOs, CTOs and CFOs were replaced. Often, the strategy of these companies changed entirely within a few years. At Salesforce, for now, everyone is staying put, and the overall strategy seems unchanged. Salesforce did have to cut deeply into its own flesh and maybe fire even more people. The focus on certain product developments and integrations seem to have increased.

Tip: Salesforce introduces Einstein GPT for sales, service, marketing and developers