R&D plays a crucial role in everything Pure Storage does. At least that’s what the company communicates to the outside world. Based on the successes the company has had since its founding in 2009, this claim seems to hold some truth. Pure invited us to visit its R&D site in Prague. Not to look at the beautiful architecture of that city, but to hear more about the architecture of Pure’s products and services. We also had the opportunity to stop by Foxconn to see how the FlashArrays and FlashBlades are assembled for customers.

Pure Storage is an American company, headquartered in Santa Clara, California. However, it is not hugely US-focused in its operations. That’s one of the first things Paul Melmon, who heads Pure’s R&D center in Prague, wants to make clear. There are three such sites (R&D sites, that is), scattered around the world. In addition to the one in Prague, there are also in Santa Clara and one in Bangalore. Importantly, the two outside the U.S. operate at the same level as the R&D center in/near headquarters. All three have “leadership,” as Melmon calls it, and cover Pure’s entire portfolio.

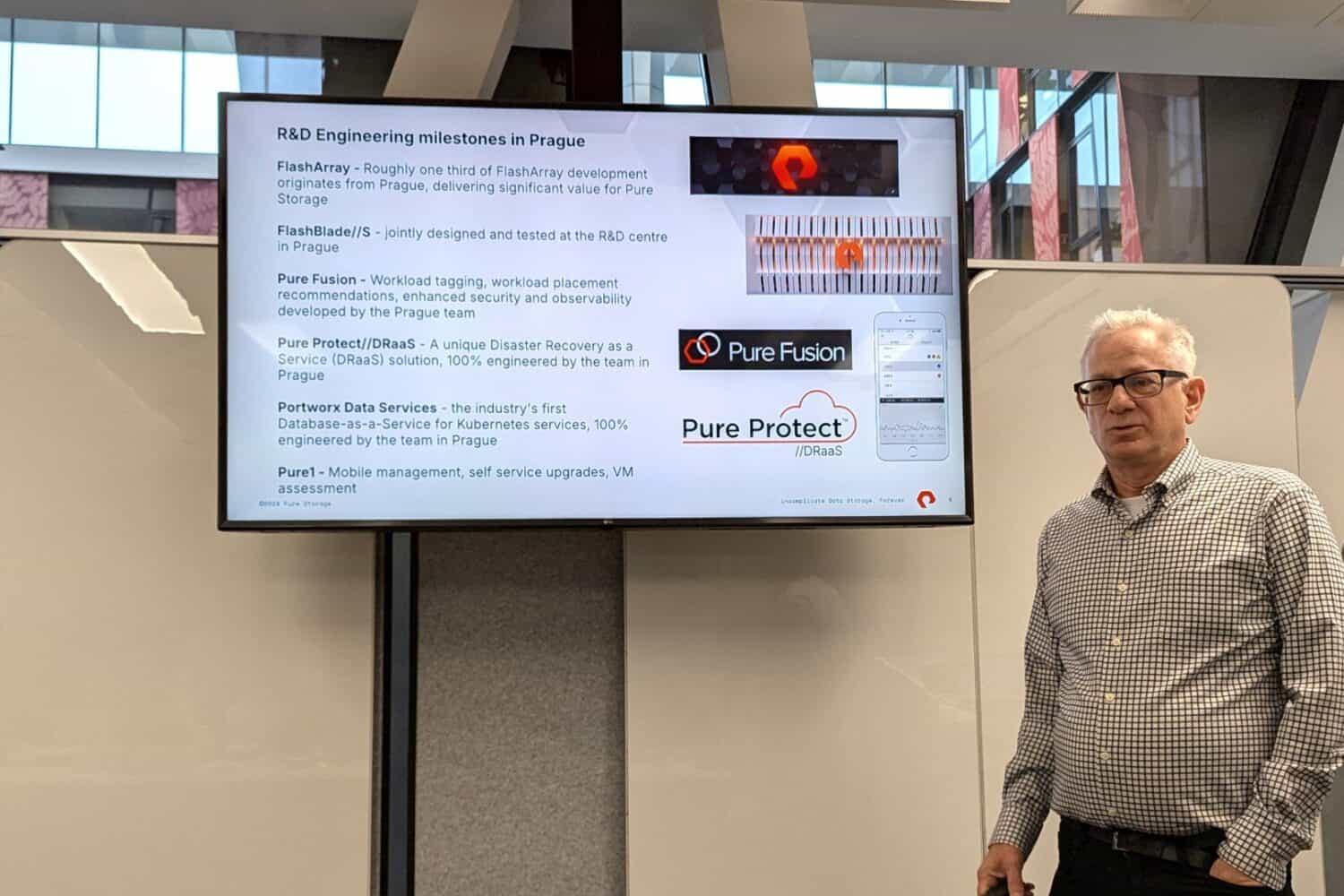

So the two locations outside the U.S. are not just given a mission to carry out a task Pure people came up with in Santa Clara. To demonstrate this, Melmon shows us a number of milestones (see picture below). The R&D team in Prague developed the Pure Protect DRaaS offering from start to finish, we learn from Melmon. Something completely different, Portworx Data Services, also comes entirely from the people in Prague. More than 600 people work at this location. It also involves more than just R&D by now. Support, finance, are among the other areas the location in Prague handles.

R&D plays central role

The role that an R&D location such as the one in Prague plays in Pure’s overall strategy cannot be underestimated easily. Pure puts just under 20 percent of its total revenue into R&D (19.7 percent, to be exact). That percentage is “much higher than that of competitors,” Melmon says. Those, he says, are in the single numbers (under 10 percent, that is).

The message is clear, R&D plays a comparatively more important role for Pure than for the company’s competitors in the storage market. Pure is a special company anyway as far as we are concerned. It is one of the few relatively large and relatively young storage companies that come to mind, if not the only one. After all, most of the big ones are pretty old and most of the young ones aren’t that big yet (and often will never be).

With revenue expected to pass the $3 billion mark in the current fiscal year, which is almost over, Pure has nestled itself among the established names in just over 15 years. Not many promising storage startups from the same period can say that. And there really have been many. The storage market is a pretty tough one, though, because competing against the big boys proves impossible for many new companies. These are then often bought up by those larger companies, or disappear completely.

No DFM without R&D

The emphasis on researching and developing new things themselves has taken Pure far. So as far as we are concerned, one of the main reasons for Pure’s success lies in R&D. It is the focus on developing something radically new, namely the Direct-Flash Module (DFM) and the software-defined layer above it, that has enabled Pure to bring something fundamentally different and, according to Pure itself, obviously better to market.

If Pure had stuck with SSDs, which it filled arrays with for the first few years of its existence, it would not be where it is today. Its Evergreen promise and the software that plays a central role in its offerings probably would have ensured that it would have some degree of success. However, can’t imagine a scenario where it would have been as successful with SSDs as it is now with DFMs. If you see how slowly other storage players are moving to SSDs, Pure would not have developed as quickly as it has.

Thanks to the story around DFMs, Pure managed to attract large companies with solid storage needs and requirements. It had something new to say that was also measurably different and, for the necessary workloads, better than other forms of storage. Thanks to its Evergreen model, which included things like subscriptions and the like, there was little customer churn. With that, the stage was set for more.

AI and storage

Fast forward to 2025, and we can see what that “more” from the last sentence of the previous section might be. AI seems set to have a fairly big impact on the storage market. Pure has been working with Meta on storage combined with AI since 2016, we hear from CTO Rob Lee, who was present in Prague too. The company now already has more than 100 AI customers.

Storage for AI is not just about performance, but actually mainly about other things. Reliability is one of them, but flexibility is undoubtedly the most important, according to Lee. Most workloads so far have actually always been fairly static; AI changes often and a lot. It’s very difficult to estimate what AI will look like in six months and therefore what this means for the storage you deploy. Flexible storage capabilities make it possible to adapt to new realities.

Impact of focus on R&D: first hyperscaler signs

Without a doubt, however, the biggest news of late around Pure was that a first hyperscaler is getting started with the company’s technology. It is one of the top four hyperscalers. Pure is not allowed yet to say which one it is. This hyperscaler, by the way, is not going to fill data centers with FlashArrays or FlashBlades. It will use Pure’s direct-flash (i.e. DFMs) and will build the rest of the infrastructure itself. Mind you, there’s also quite a bit of software development involved, Lee points out. They are developing this jointly, to best integrate things on both sides.

Here again, the focus on R&D and thus the development of DFMs is paying off. “All of the top hyperscalers have had internal projects to build something like direct-flash,” Lee points out. The hyperscaler now signed to Pure also had such a project, he says. Eventually, however, they came to the conclusion that it made more sense to just knock on Pure’s door. In itself, this is not surprising. It’s also in line with something John ‘Coz’ Colgrove, one of Pure’s founders, said to us just last year: “Basically anyone can make what we’ve made [DFMs, ed.], but we have a huge head start.” In other words, if you have to develop it yourself now, it’s going to take a long time. It might make more sense to just go buy it from someone who already developed it.

The co-engineering partnership with the hyperscaler does raise some questions for us about the roadmap, including R&D. After all, Pure prides itself on standardizing a lot. That is, the vision is that everything is part of the same (software) platform, in the form of FlashArray or FlashBlade. The same 150TB DFM can be in a FlashArray or in a FlashBlade. With the new “hyperscaler flavor” of the DFM, this seems to be coming to an end. Lee assures us, however, that this is not the case. This will mainly be about some very specific developments. Pure will not start the development of fundamentally different modules. It’s actually rather the opposite. The idea is to create a standard for direct-flash that is also of interest to smaller hyperscalers.

Even thought it’s not entirely clear what the exact impact will be on Pure’s roadmap, one thing is already quite certain. The complete switch (on all tiers) to flash from the hyperscaler will impact the HDD market quite significantly. 60-70 percent of HDD vendors’ revenue comes from hyperscalers. This hyperscaler is the first, but it’s only a matter of time before the others switch as well. That is at least what Lee and Pure Storage expect. That makes sense to us, too. “If one of them flips, and doesn’t buy them anymore, you can see where that is going,” in Lee’s words. It’s only going in one direction, and it’s not that of HDDs, is the point he wants to make.

R&D also means a lot of testing

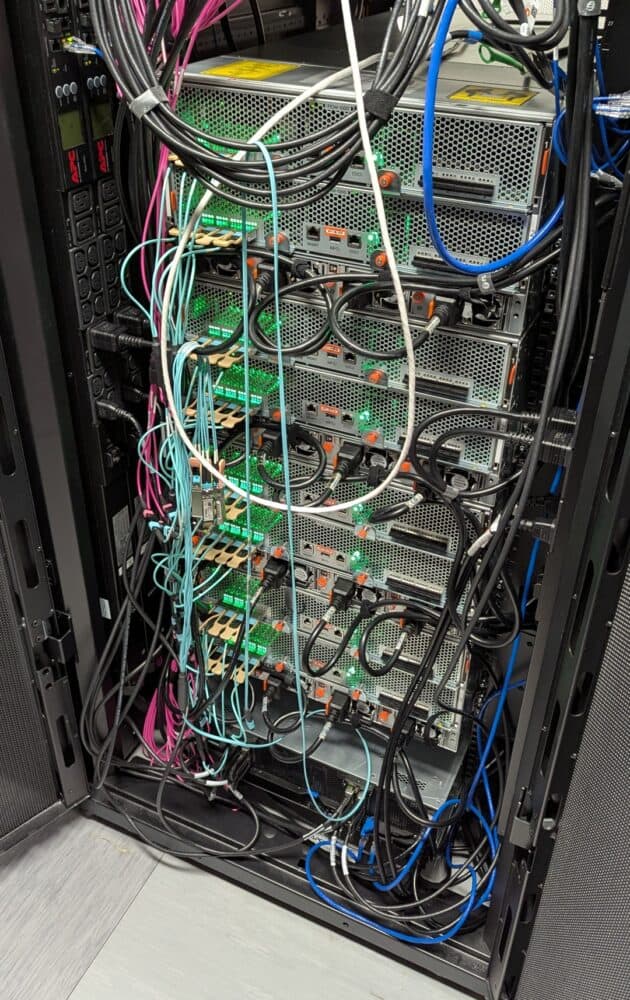

Anyway, back to Prague and the R&D center there. An important part of that, without a doubt, is the testing environments it has there. There, employees test all sorts of possible and imaginable things. Worldwide, Pure has tens of thousands of testbeds. We take a look at a lab where FlashBlade is extensively tested.

There are different kinds of testbeds. On the one hand, there are so-called persistent testbeds. These are test environments that go through the same journey as customers. That means all kinds of software runs on there, as if it were a real production environment at a customer’s site. When there’s an update for a specific piece of software, they install that too, so as to find potential disruptions that impact the performance of Pure’s systems. And to assess whether Pure can do anything about it. This covers a diverse array of software, from testing whether VMware ESXi runs well to making sure SQL databases running on the devices perform as well as they should. In one of the racks, we spy an Nvidia DGX unit. That environment runs LLM workloads to see how they perform and if Pure needs to adjust anything.

On the other side, we have the non-persistent testbeds. This is where Pure employees in the R&D lab focus on specific components of the units. Examples include the Ethernet connections. Since FlashBlade is Ethernet-based, those are very important. There are also tests of active optical cables, for example with tools to test the loss of light (and therefore data) in these types of cables.

Finally, Pure’s evergreen claim is physically visible here. One of the FlashBlades in the test lab has been running continuously since 2016.

More testing before shipping

The last stop during our visit to Prague is the Foxconn site at about an hour and a half by bus from the city. Foxconn is a major player in the Czech economy. After Skoda, it is the country’s second largest exporter. Mind you, these are not exclusively Pure Storage products. The company also works for other vendors. In the factory where we are, for example, Foxconn also works for Cisco. For Pure, Foxconn can assemble 30 FlashArrays, 4 FlashBlades and 160 so-called FRUs here. FRU stands for Field Replacable Units and could be thought of as the individual components. This could be a controller for one of the units as well as SFP connectors for the network connections.

This Foxconn location is not so much a factory as an assembly location. That is, this is where components come from all over the world. The employees turn them into working FRUs, FlashArrays and FlashBlades, completely to the customers’ requirements. After they do this, Foxconn ships the products.

This is also where the final testing of the configuration takes place. Pure wants to make sure everything works exactly as it should, our guide in the factory tells us. Factory employees literally test every component. Even the RAM slots that a customer doesn’t even use in the configuration they ordered are tested. After all, you never know when the customer will need them. Furthermore, there is a line where the FlashArrays and FlashBlades get burn-in tests, the maximum load over a long period of time. If they pass this test without any problems, they can finally be packed and prepared for transport.

Finally, we noticed during the tour that it’s mostly women who work in this Foxconn factory, at least in the Pure section of it. This is not accidental, we hear from our guide. Women are more careful (“sensitive”, was het word he used) and understand the value of the products better, according to him. We are not talking about cheap products here, so that is obviously an important criterion for being able and allowed to work here. If you have to do an ESD test every time you want to work in this factory (which is the case here), then it is a good thing that you handle all of the materials carefully too.

Testing and improving until the last minute

After our visit to the R&D site in Prague and the Foxconn factory just outside it, two things are clear. Pure takes R&D very seriously, but also does not forget to continuously test and improve everything it produces and sells as well. Only with this combination can the company actually deliver on its big promises. Pure’s continued strong growth in the market seems to indicate that this combination is part of a winning formula.

Without all the big investments in R&D, Pure Storage as we know it today would never have materialized. Then the DFMs might not even have gotten there. And without DFM, Pure would have been little more than one of many players in the market. Now it has actually brought something unique to the market (although IBM also has proprietary flash, albeit substantially different from DFMs). That unique component, coupled with the vision of having everything be part of a single platform, is catching on in the market. It has even convinced a hyperscaler.

Mind you, without rigorous testing of the final hardware, a DFM is also nothing more than an interesting piece of technology. That’s where the R&D department in Prague and the assembly line at Foxconn come in. These should ensure that customers can use their FlashArray or FlashBlade for years to come. They should be able to do this regardless of the workloads they run on it, but also with the flexibility to keep up with new developments in the market. So far, Pure Storage is succeeding extremely well. Based on our impressions, we see no obvious reason why it should slow down.

Also read: Pure Storage wants to make hard drives permanently obsolete