With combined annual revenues of $600 million (€518.5 million), they will gain greater control over data infrastructure. The goal: to end the complexity of data management.

With AI rapidly advancing across all sectors, organizations need reliable, readily available data. “As AI reshapes every industry, organisations need a foundation they can trust — one that is open, interoperable, and built to scale,” explains George Fraser, who will lead the company as CEO of Fivetran.

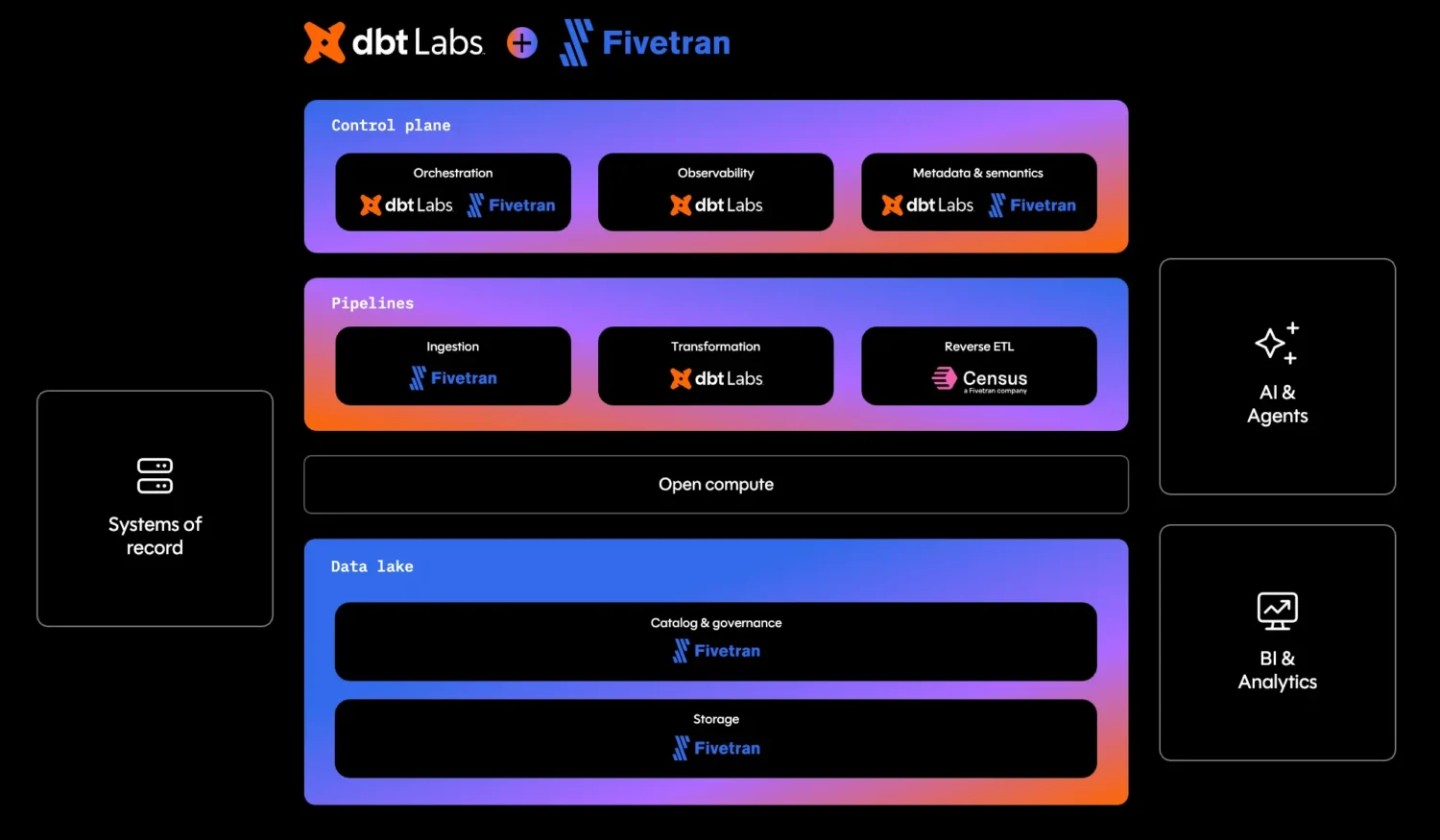

Organizations are currently struggling with complex links between various data tools. The new platform promises an integrated solution that seamlessly connects data movement, transformation, metadata, and activation without compromising flexibility.

Open standards

The merger is what Fraser calls a refounding moment for Fivetran and the broader data ecosystem. The emphasis on open standards such as SQL and Apache Iceberg is central to the strategy, allowing customers to avoid vendor lock-in.

Tristan Handy, founder of dbt Labs, will take on the role of President and co-founder. “dbt has always stood for openness and practitioner choice,” emphasizes Handy, who spent nearly a decade working on infrastructure that supports a variety of engines, formats, and tools.

A crucial commitment in the deal is that dbt Core will remain open source under the current license. The community that has grown up around dbt will continue to play a role in the platform’s further development.

This promise aligns with Fivetran’s previous strategy of systematically building an end-to-end data management platform. With the recent acquisition of Census for reverse ETL functionality and now the merger with dbt Labs, this vision is taking shape.

Merger details and future prospects

The boards have approved the transaction of directors and shareholders of both companies but is still awaiting regulatory approval. Until final completion, Fivetran and dbt Labs will continue to operate as independent entities. The merger is expected to be completed within a year.

Fivetran was last valued at $5.6 billion in 2021. dbt Labs raised money in early 2022, when it was valued at $4.2 billion. The companies have joint investors, including Andreessen Horowitz.

Both parties engaged renowned advisors to guide them through this deal. Qatalyst Partners acted as the exclusive financial advisor to Fivetran, while Morgan Stanley served in the same capacity for dbt Labs.