Research by Synergy Research Group’s market specialists shows that data center hardware and software are still very much in demand. Most of these investments come from public cloud parties. Investments in data center hardware and software for on-premise data centers are declining.

Suppliers of data center hardware and software have not had anything to complain about in the past year, according to the 2019 market report. According to the market specialists, the annual turnover in this market segment worldwide grew by 2 percent compared to 2018 to a total of 152 trillion dollars. Specifically, this concerns all cloud and non-cloud hardware and software applications and solutions.

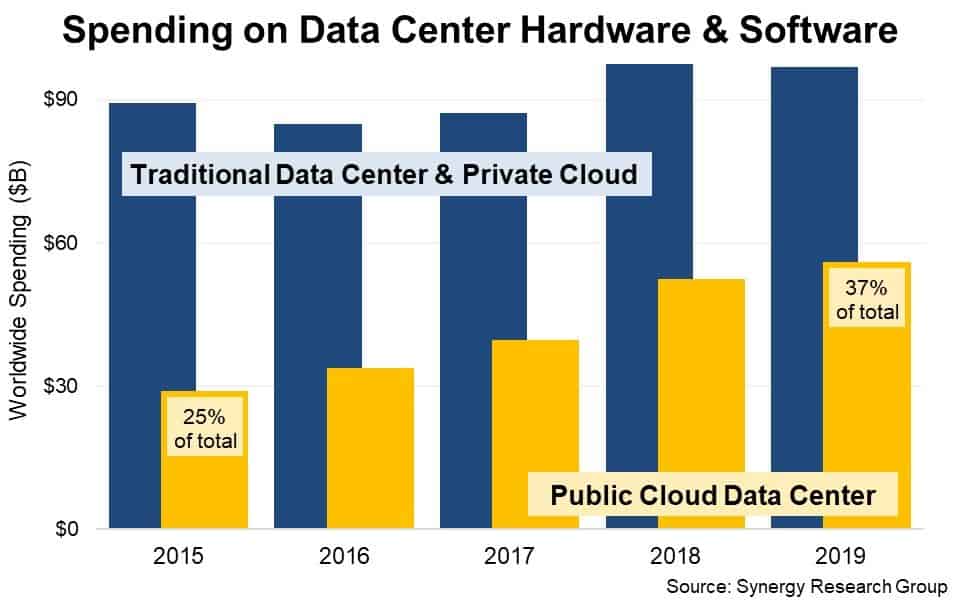

Most of these investments were made by the big public cloud vendors, according to the experts of the Synergy Research Group. Expenditure by this group of providers increased by 7 percent in 2019, while investments by companies for their own on-premise data centers and/or private clouds only increased by 1 percent. Public cloud providers now account for approximately 37 percent of all investments. In 2018 this was still 25 percent.

Reasons for growth of public cloud investments

The experts state that the increase in the number of investments in data center hardware and software by public cloud vendors is not really surprising. This is mainly because the business demand for IaaS and PaaS services continues to grow. In 2019, cloud services revenue increased by an average of 39 percent. SaaS services grew by 26 percent, e-commerce services by 24 percent and search/social networking services by 20 percent. All of these services contributed to the growing demand for public cloud infrastructure, according to the researchers.

On the other hand, the demand from companies for hardware and software for their own data centers and private cloud environments decreased as more and more workloads are migrated to the public cloud.

Servers and traditional vendors are popular

The experts also investigated which hardware and software is doing well within the data centre segment, both with public cloud providers and independent companies. The most sold hardware are servers. This hardware will account for more than half of the total investment of $152 trillion in 2019. It should be noted, according to the Synergy Research Group, that for the first time, more servers are now being purchased by public cloud parties than by private companies.

The hardware and software of the traditional data center hardware and software vendors are particularly popular. Especially with the public cloud parties. Hyper-scale providers, such as Microsoft, Google and AWS, also see more in the hardware and software of the traditional suppliers, according to the research.