Nvidia’s acquisition no longer seems possible as U.K authorities declare it a threat to national security

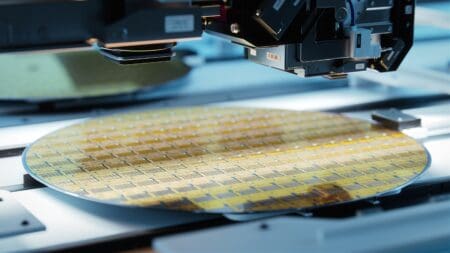

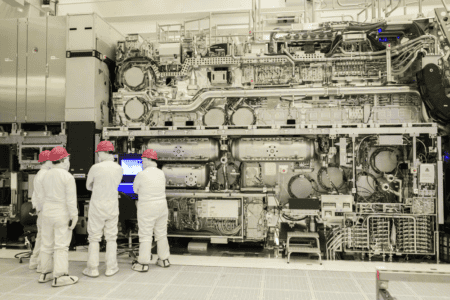

Nvidia is one of the biggest U.S. chip companies in terms of market capitalization. In September, they announced that they plan to acquire Arm Ltd. from SoftBank Group Corp based in Japan in a bid to enter the growing market for semiconductors.

SoftBank is selling assets so that cash can be raised for fresh investments and buybacks in startups.

However, the U.K wants to block this takeover because of the potential risks to national security.

Why did the U.K. make this consideration?

In April of this year, Oliver Dowden, the Culture Secretary of the U.K., asked the CMA to prepare a detailed report about if the deal is anti-competitive, alongside a summary of concerns regarding national security as seen by third parties.

The final assessment was delivered at the end of the last month and showed how the national security of the U.K. was at risk, which means there is an inclination towards rejecting this acquisition. The U.K will be conducting a more detailed review of the merger and issues surrounding national security.

What does it mean?

The decision has not been finalized, and the U.K. may still approve the deal by imposing certain conditions. In addition, Dowden will decide whether competition authorities of the U.K need to examine this merger further.

A spokesperson from Nvidia said that “We continue to work through the regulatory process with the U.K. government. We look forward to their questions and expect to resolve any issues they may have.”

If regulators block the deal, SoftBank may have to pursue an IPO of ARM Ltd. However, Simon Segars, the CEO of ARM, said, “The combination of Arm and NVIDIA is a better outcome than an IPO.”