Many organisations have recently reinvented commerce activities. The corona crisis meant that many things had to change overnight. Technology often plays a crucial role in innovation, as well as laying the foundation for new channels. E-commerce proved ideal for continuing the business and is also preferred by many customers. It is expected to bring about a permanent shift.

After a crisis of about a year and a half, it is clear that companies have adopted relatively fast. After all, they had to respond to the behaviour of consumers and business relations. It does not apply to every company, as some were able to continue their activities as usual. However, many organisations could no longer rely on their old model. It led to innovation, which is still helpful for the years to come.

For commerce, the disruption was also significant. Salesforce, therefore, researched the effects of the pandemic on the behaviour of consumers (B2C) and business customers (B2B). The CRM giant also looked at shifts in engagement and expectations, the impact of digital sales on the role of sales and how sales change. For the State of Commerce report, Salesforce surveyed nearly 1,400 business owners from a wide range of industries. It also analysed the behaviour of more than one billion private and business customers.

It is important to note that the respondents are divided into three levels. The ‘excellent performers’ qualify their organisation’s success with digital sales as extremely successful. The second group, ‘average performers’, consider digital sales to be somewhat successful. Finally, there are the ‘poor performers’. They qualify digital sales as not successful or did not invest in it at all. In this article, we will regularly refer to one of the groups.

B2C organisations

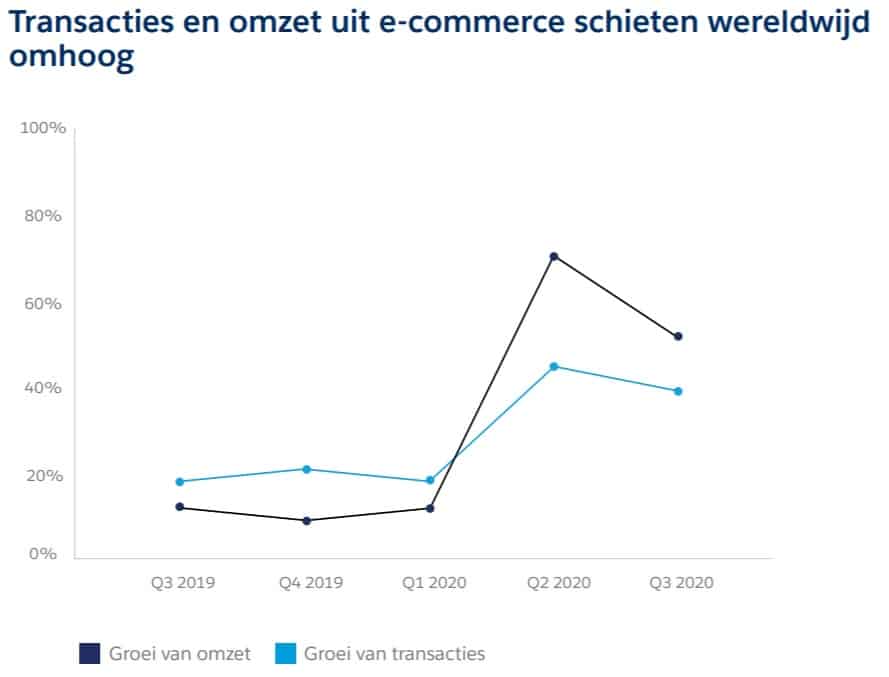

Due to Covid-19 restrictions, non-essential businesses had to temporarily close their shops or receive fewer visitors, which pushed e-commerce. While it was already an essential channel before the pandemic, there has been an absolute explosion in e-commerce sales and transactions. Consumers are surfing the web more than ever, and this has caused a historic change. With the graph below, the Salesforce report clearly shows the growth. The darker line shows the revenue growth, while the light blue line shows transactional growth.

The forced closure of shops and the accompanying changing consumer behaviour caused B2C organisations to shift investments to digital experiences. Especially the excellent performers are offering more digital experiences. Two-thirds of this group indicates that personal contact will be extended more with digital experiences compared to 2019.

Consumers’ shift to digital shopping made B2C companies experiment with new customer engagement strategies. They looked for ways to offer the same level of personal attention to the customer online. The popular options to complement physical shopping experiences are live chat or video, virtual events, and virtual shopping appointments/style advice.

While innovation proved to be a way out and thus a clear benefit, the Salesforce survey shows that B2C organisations still need a physical store. For example, during the pandemic, stores became a processing location for online orders. It is essential for growth, the study states. American retailers with a pick-up option are achieving higher annual sales growth than retailers without a pick-up option. It is unclear whether our region can confirm this with figures. However, the possibilities with limited contact are essential for customers who opt for convenience and security.

Direct-to-consumer

Direct-to-consumer (D2C) initiatives have also exploded in recent months. As the pandemic spread, the number of digital purchases of essential products directly from manufacturers increased by 200 per cent compared to a year earlier. Otherwise, those purchases would take place in the supermarket. It is expected to be a lasting change, as 68 per cent of consumers wants to continue buying essential products online after the corona pandemic.

D2C transactions allow manufacturers to make more sales. “Consumer goods (CG) manufacturers were already noticing the trend before the pandemic. Although the direct channel only contributes an average of 5 per cent to the total revenue of most CG companies, it still contributed 40 per cent to the growth,” said Salesforce. The pandemic was cited as a catalyst for growth. Essential goods, in particular, were in demand during the crisis, including through online channels.

Despite the benefits, Salesforce does see obstacles for B2C entrepreneurs in building D2C relationships. The biggest obstacle: higher consumer expectations. It is closely followed by the lack of first-hand data from retailers. Just over half of the CG companies find it challenging to convert customer data into insights.

New channels

With fewer visits to physical stores and more frequent use of digital alternatives such as apps and sites, the pressure on companies to serve customers through these channels is also increasing. Excellent performers believe that a brand must become part of the channels and devices consumers spend the most time on. In this case, the shift from physical to digital means primarily social media. Traffic to websites from referrals via social media grew 104 per cent year-on-year in the second quarter of 2020. Consumers went beyond browsing in the process. Orders placed after social media referrals also showed an annual growth of 104 per cent.

In addition to brand awareness, context-dependent selling is an important reason for investing in new channels. With context-dependent selling, companies introduce sales into digital channels such as social media, gamification, voice platforms and virtual reality. To manage sales via these channels, companies invest in different systems. Content management systems are often chosen.

B2B and e-commerce

The issues mentioned above mainly relate to B2C. However, Salesforce’s State of Commer report also looked at B2B in combination with e-commerce. It is clear that the rapid shift to digital also occurs in B2B companies. The majority already sells online, and most continue to invest in digital channels. Three out of ten entrepreneurs derive half or more of their revenue from digital channels. The majority even expects more than half of their revenue from this kind of sales within three years.

Many B2B companies have therefore increased investment in digital sales over the past year. Business owners generally experienced the associated remote sales as ‘good’ or ‘very good’ during the pandemic. According to data from a Salesforce cloud solution, this was also necessary, as the number of B2B orders via e-commerce increased by 44 per cent between January and August 2020. According to B2B companies in Western countries, the investments in e-commerce were therefore successful.

Traditional model

What is striking is the difference between digital sales and personal sales. The average purchase amount of self-service orders is about half as much as that of purchases through a salesperson. A combination of traditional and digital sales models for B2B entrepreneurs, therefore, seems desirable.

More than half of the excellent performers invest in personal sales teams, despite the increase in digital sales. 52 per cent of this group will be increasing in sales teams themselves in the next two years. However, there is division over the role of personal sales teams. People tend to favour higher investments in sales teams in the industries drugstore, foodstuff, medical equipment, and consumer goods. In other sectors, entrepreneurs think they will invest more in e-commerce solutions. In general, the growth of the e-commerce channel has little negative impact on the size of the sales force and sometimes even increases the size of the team.

At the majority of companies, e-commerce has relieved sales of the logistics behind order processing. Instead, employees have developed into strategic advisors. 59 per cent of sales employees have been retrained to focus more on other departments, such as marketing. It also happens that sales employees are transferred to other regions.

Customer data

Furthermore, 88 per cent of the sales employees see the importance of anticipating customers’ needs, mainly because of the current economic conditions. It requires customer-specific insights, which are usually generated from sales meetings and recorded in systems. Think of the communication and purchase history of customers. If the information is tracked correctly and maintained, sales will better understand customers and their needs. It makes it easier to offer a more personalised customer experience and to capitalise on opportunities.

Lasting change

In general, Covid-19 has definitively changed several things. IT innovations were rapid, which also changed and increased e-commerce activities. Both B2B and B2C companies looked for new channels and ways to maintain sales during the pandemic. The innovation has laid a solid foundation for the future, which will benefit from it for years to come. E-commerce will continue to play an essential role for B2B and B2C companies. Even when Covid-19 is less prominent in the future, customers plan to continue purchasing digitally.

Are you curious about more specific figures and trends from State of Commerce? Take a look at the Salesforce report.

Also read: Are AWS and Salesforce going to get married?