Now that Apple has turned its focus to virtual reality, it looks like it may get five competitors. Qualcomm this week announced the Snapdragon XR2+ Gen 2, which promises a slight improvement on previous chipsets. However, it’s software where the renewed VR battle is heating up, with help from Google.

The Snapdragon XR2+ Gen 2 supports a maximum resolution per eye of 4.3K, considerably more than the 3K per eye enabled by the XR2 Gen 2 in the Meta Quest 3. The number of supported cameras has also been increased from 10 to 12, and the CPU’s clock frequency has been raised by 20 percent, while the GPU now runs 15 percent faster.

Tip: Apple Vision Pro: will it shake up the way we work?

Qualcomm states that there are “more than five” OEMs working on hardware, although only four have been disclosed for now. These are Samsung, HTC Vive, Immersed and Play for Dream. Samsung appeared to have already shaken up its own VR plans after Apple announced the Vision Pro.

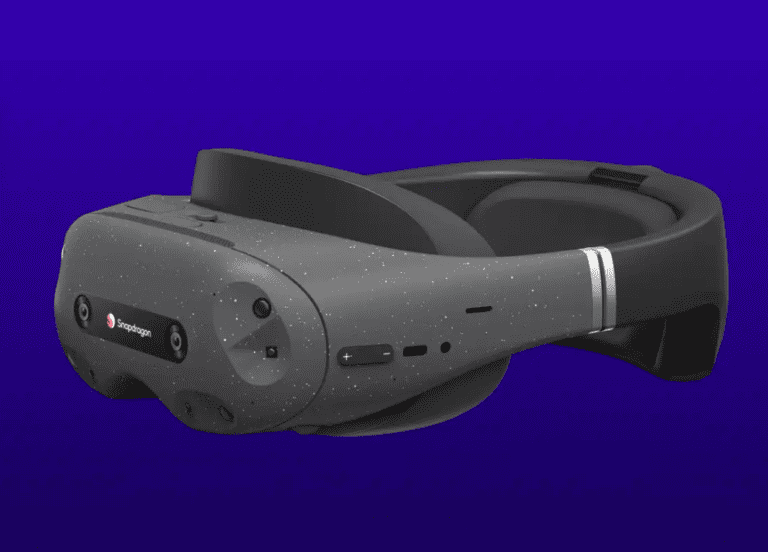

Qualcomm has unveiled a reference design, as shown in the image above. However, manufacturers can deviate from it, as Windows Mixed Reality OEMs have done, for example.

Competition will be mostly about software

Qualcomm says that the new chipset was developed in collaboration with Samsung and Google. The latter’s inclusion appears to stem from a software involvement, given it’s not listed as one of the hardware manufacturers. With that, a similar competitive battle to iOS versus Android seems to be beginning at the VR level. In doing so, it will not be hardware but software that will make the difference, as noted elsewhere online. This is because the requirements of VR technology do not depend on raw performance. To make a headset light enough and provide it with enough battery life, efficiency and cooling are more important.

In addition, a major problem for VR adoption has been that the software ecosystem is currently a disorganized mess. While professional applications with Microsoft’s HoloLens 2, for example, have been successfully implemented for specific use-cases, Windows Mixed Reality never took off with consumers. Meta also has its own platform for Quest users, which occupies its own isolated space dominated by its faltering Metaverse project. Only Valve has a mature ecosystem (Steam VR) with its Index headset, although this specifically targets the video game market. There simply isn’t a mature OS for users to land on in the consumer space.

Apple versus Android?

The challenge will be to give users a unified VR home, then. Apple’s walled garden is ideally suited for this, with a proven history of integrations between its desktops, laptops, phones, tablets and other devices. Vision Pro users will be able to rely on their purchase working smoothly with existing apps, the only limiting factor being adoption rate. The staggering $3,500 price will no doubt be a barrier to that, at least until Apple perhaps finds a way to launch a non-Pro variant at some point.

Samsung seems to be trying to foster its own ecosystem, offering a “best-in-class XR experience for Galaxy users.” With smartwatches, smartphones, tablets and earbuds, the S23 line already showed that it can create its autonomous environment within Android.

Regardless, an uncertain VR market awaits all parties. Meta already scaled back production rates of the latest Quest 3 late last year when demand appeared to be falling short of expectations. Ultimately, VR applications should be used more as tools than toys, Stanford researcher Jeremy Bailenson stated last year. That switch, in addition to the maturing of software ecosystems around VR, will be decisive for the technology to succeed this time.