The global chip shortage rages on. Supply still diverges from demand. Although manufacturers and governments initiated promising solutions in the past year, the challenge seems unbridgeable for now. Here’s why.

Anyone currently ordering a game console, smartphone or car risks paying more or waiting longer than two years ago. Virtually all hardware depends on chips. Demand is as huge as supply is short. Chip manufacturers are no longer able to meet the demand for processors.

The problem has been looming for some time. The Internet became more accessible with the advent of smartphones and mobile devices. Businesses digitalized, the demand for networking equipment and processors for cloud computing increased. Chips are required for every household, office and data center. Demand grows parallel to digitalization. Supply has been struggling to keep up, and today’s chip shortage is by no means a first.

In 2004, American and Indian telecom organizations collectively switched to a new network technology (CDMA). The supply of adequate chips was jeopardized. Phone deliveries were delayed or not halted for six months. In 2011, a chip factory in Japan fell silent due to an earthquake. A year later, the supply of flash memory and displays had still not been restored.

The impact of both examples was significant. Yet, nothing compares to the severity of the problem we’ve been facing since 2019. Similarly, a telecom market change or earthquake in Japan are incomparable to the shift that COVID-19 brought about. Since the advent of the Internet, no event has shaken up the global market more than the pandemic. The current shortage has multiple consequences and causes.

Tip: Intel’s strategy has failed, won’t recover until 2025?

Manufacturing market

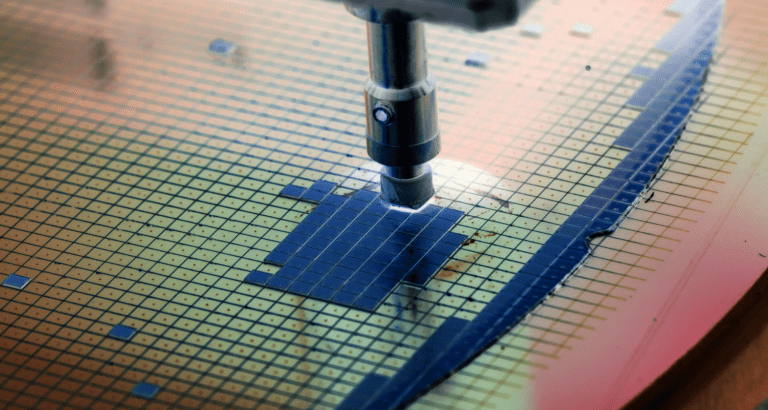

Before expanding on the latter, it’s important to understand how the manufacturing market functions. There are chip designers, manufacturers and organizations that both design and manufacture.

Examples of chip designers are Qualcomm, Nvidia and AMD. Such organizations design a chip and deliver the specifications to a manufacturer. The manufacturer produces and returns the model. A chip designer does not have its own factory. A manufacturer does. They traditionally make a living by producing others’ designs.

A manufacturer does not venture into the marketing or sales of chips, which guarantees a healthy relationship with designers. The Taiwan Semiconductor Manufacturing Company (TSMC) is by far the most successful example.

Finally, there are organizations that both design and manufacture. Intel, IBM and Samsung are exemplary. These organizations design proprietary chips and manufacture in proprietary factories. Production capacity is usually inferior to a focused manufacturer like TSMC. As such, an organization like Intel regularly partners with manufacturers to meet chip demand.

The problem

The cause of the current chip shortage cannot be pinpointed with a single organization, organizational type or event. The problem has multiple sources.

First of all, the manufacturers of most global chips can be counted on one hand. TSMC’s worldwide market share is estimated at more than 50 percent. Organizations with their own factories, including Intel, depend on TSMC to meet chip demand. TSMC’s supply has limits. If an organization faces rising demand, but fails to timely place an order at TSMC, the rising demand will be met too late.

That’s exactly why the automotive industry faces a chip shortage to date. In late 2019, at the foot of the corona crisis, automakers predicted a decline in demand for vehicles. They cancelled orders with TSMC. A year later, demand appeared to be increasing. Attempts to reinstate orders were in vain. TSMC’s schedule had been adjusted in the meantime. Its hands were full with chip production for consumer equipment. Organizations that had submitted their orders on time were given priority. In short, production capacity was insufficient to serve every chip-dependent market.

In a recent interview, Jensen Huang (CEO of Nvidia) confirmed that the latter problem began well before the pandemic. Nvidia’s equipment has long been bought up by cryptominers and ‘scalpers’; individuals who buy out stock, create scarcity and resell equipment at a higher price.

Thus, chip supply and demand has undoubtedly been on shaky ground for some time. Existing factories have insufficient capacity to meet the rising demand for technology. The market forces of the pandemic proved to be the straw that broke the camel’s back.

Solution to the global chip shortage

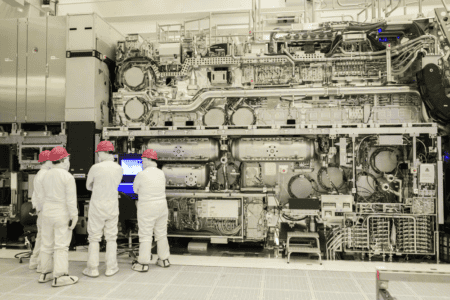

Building more factories is the most obvious solution. In the past year, chip manufacturers Samsung, Intel and TSMC announced billion-dollar investments to increase production capacity. The bulk of these investments is to be used to construct new factories.

In turn, the European Union and the United States launched initiatives to encourage the establishment of Western factories. While the EU announced projects to increase collaborations among European manufacturers, the U.S. pumped billions of dollars into building factories on its land.

The solution of new factories is as apparent as it is effective. Market researchers at IDC predict that current initiatives could lead to chip overcapacity by 2023. Yet, for now, shortage remains a reality. There’s a lot of room between the intention to build a factory and the actual supply of new chips. While the solution’s foundation has been laid, it is years away from realization.

In the meantime, adjusting production priorities is the only salvation. According to Bloomberg, TSMC recently made more capacity available to produce chips for automakers. While that promises to mitigate the rise in vehicle prices, demand for consumer devices is simultaneously increasing. As long as the new factories remain unbuilt, any change of production course has a downside.