Qualtrics International, a company focused on developing survey software, has filed for an initial public offering. Qualtrics is a subsidiary of software company SAP.

Reuters expects the company to offer up to 100 million dollars in shares. This is approximately 82 million euros. SAP bought the company for 8 billion dollars (6.5 billion euros) two years ago. Rumours that SAP was planning this IPO have been around for six months.

Qualtrics applied for its Class A shares to be listed under the ‘XM’ symbol and expects them to be worth between 20 and 24 dollars (16 and 20 euros). The Class B shares will be in the hands of SAP, thus keeping control over Qualtrics in its hands.

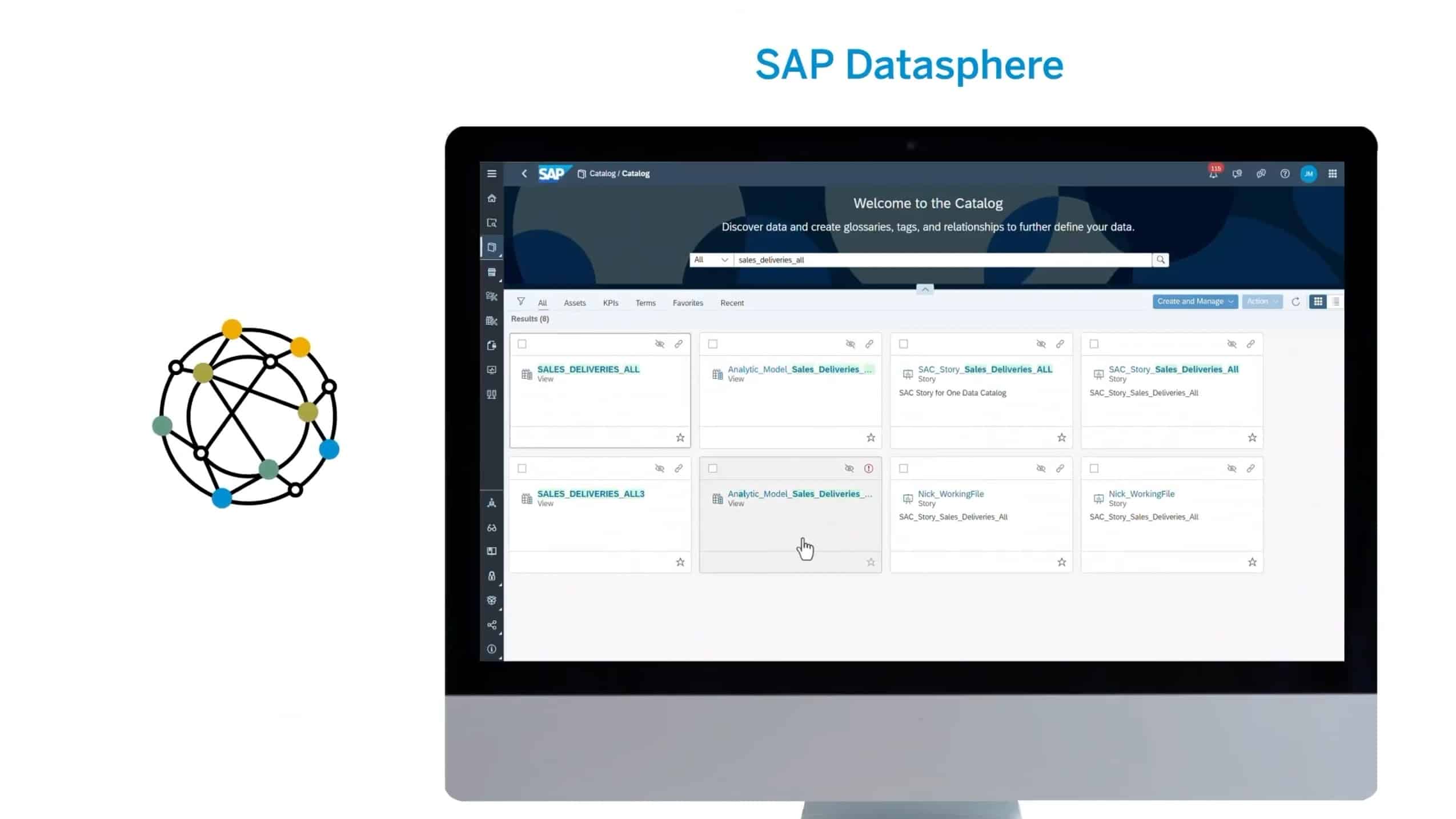

SAP and Qualtrics

SAP acquired Qualtrics in 2018. SAP intended to combine its own operational data with experience data and insights gained with Qualtrics’ survey software.

SAP is working hard to integrate Qualtrics software into its own products. Last month SAP released its Cloud Platform Workflow software. In this low code workflow builder, users can easily add Qualtrics surveys.

Tip: SAP to acquire Emarsys to enhance its customer experience operation